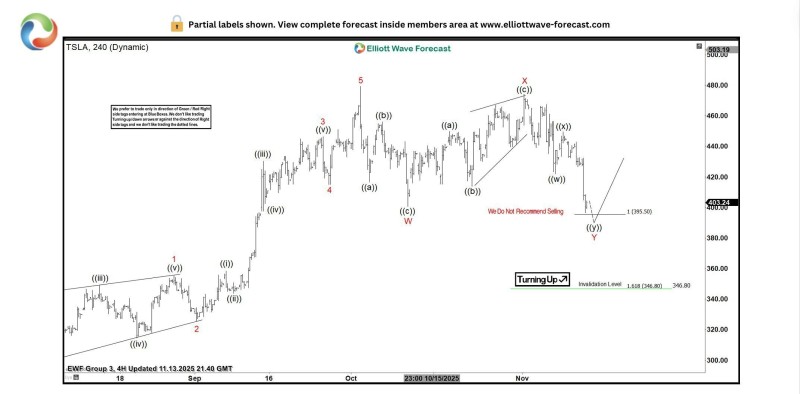

⬤ Tesla shares have hit a critical technical zone after pulling back into what Elliott Wave analysts are calling an extreme area. TSLA has dropped from the $480-$500 range down to support around $395-$400, where buyers typically start stepping in. The setup suggests we could see at least a three-wave corrective bounce from these levels.

⬤ The pullback appears to have completed its corrective wave structure based on the four-hour chart. The stock has stabilized near the lower boundary, and the chart explicitly warns against selling at these levels—a sign the downside move may be running out of steam in the short term.

⬤ The Elliott Wave projection points to a potential three-wave corrective rebound rather than a full trend reversal. A "Turning Up" signal reinforces the view that short-term downside pressure is weakening. The chart outlines a rebound path following the pullback completion, consistent with a corrective recovery phase.

⬤ This matters for the broader market because Tesla remains a major sentiment driver in tech and EV sectors. Short-term turning points in TSLA often coincide with momentum shifts across growth stocks. The extreme pullback zone highlights how technical structures continue guiding volatile markets, with TSLA's next move potentially setting the tone for near-term trading.

Usman Salis

Usman Salis

Usman Salis

Usman Salis