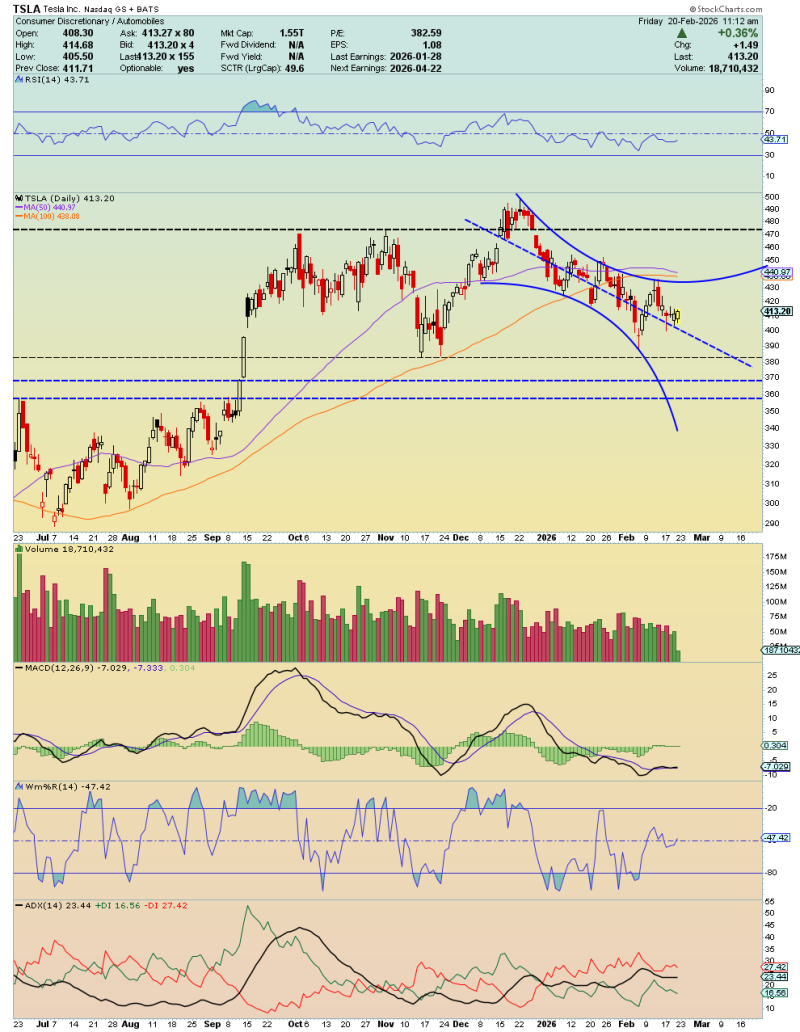

⬤ Tesla (TSLA) is trying to find its footing after a recent pullback, holding on to a key support band that traders are watching closely. Сlose above $421 would give the bulls a clear green light, though staying above the $404-$409 range is already showing enough technical strength to keep the bounce alive.

⬤ The chart tells the story: TSLA is trading near the low-$410s after dipping to around $405 and bouncing back. Moving averages are at a crossroads too, with the 50-day sitting just above the 100-day. That tight squeeze keeps the "dead cross vs turnaround" question front and center for the next week. Alongside that, trading volume has been sliding for months, which suggests TSLA is approaching a make-or-break moment where any breakout will need real buying pressure to stick.

⬤ If TSLA can push past $421, the next target sits at $427+, with the potential for more upside toward the $451-$452 zone if shorts get caught in a squeeze. But structure matters here.

⬤ The setup is worth paying attention to because TSLA is sitting right where trend, volume, and key levels all meet, which can amplify the move once direction is confirmed. For more context on nearby TSLA technical zones, check out related coverage on thetradable including TSLA Holding Strong Inside Rising Channel - $420 Support in Play.

Peter Smith

Peter Smith

Peter Smith

Peter Smith