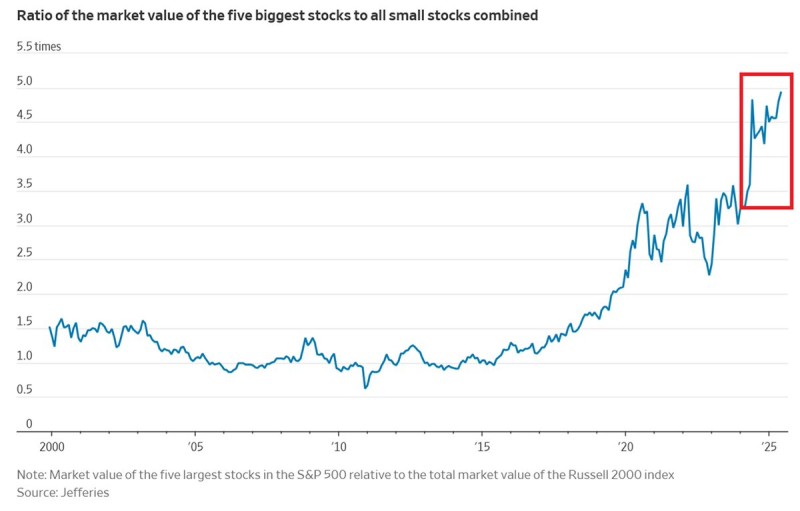

Something remarkable is happening in the stock market that should make every investor sit up and take notice. The five largest U.S. companies have grown so massive that they're now worth nearly five times more than every small-cap stock in America combined. This isn't just another market milestone—it's a fundamental reshaping of how wealth gets distributed across the financial landscape.

NVDA Price Explosion Breaks All Records

The numbers behind this shift are absolutely staggering. Nvidia (NVDA) didn't just ride the AI wave—it practically became the wave itself, with its stock price rocketing an mind-blowing 5,109% over recent years. That's not a typo. While most investors were still figuring out what artificial intelligence meant for their portfolios, NVDA was already rewriting the playbook for tech stock performance.

The other tech heavyweights weren't exactly sitting on the sidelines either. Microsoft jumped 435%, Apple climbed 463%, Amazon gained 203%, and Meta surged 440%. Meanwhile, small-cap stocks represented by the Russell 2000 managed a comparatively modest 66% increase. It's like watching a Formula 1 race where four cars lap the entire field multiple times.

Market Concentration Reaches Dangerous Territory

Here's where things get really interesting—and potentially worrying. A new chart from Jefferies reveals that this 4.9x ratio between big tech and small caps represents uncharted territory in market history. Even during the infamous Dot-Com Bubble of 2000, when everyone thought tech stocks could only go up, the ratio peaked at just 1.5x. Before the 2008 financial crisis hit, it was sitting at a balanced 1.0x.

What we're seeing now makes those previous periods look almost quaint by comparison. Since 2019 alone, this concentration has tripled, meaning capital has been flowing into fewer and fewer baskets at an accelerating pace. The S&P 500 has essentially become a bet on whether five companies can continue their unprecedented growth trajectories.

Wall Street analysts are starting to whisper about systemic risks. When such a massive portion of market value depends on just five companies, what happens if one of them stumbles? The interconnected nature of these tech giants means that a significant pullback in NVDA price or its peers could send ripples throughout the entire market ecosystem.

Usman Salis

Usman Salis

Usman Salis

Usman Salis