SoundHound AI (SOUN) stock plunged nearly 30% after Nvidia (NVDA) disclosed it had exited its stake in the company. Despite a strong revenue outlook, investor sentiment took a hit. Is this dip a buying opportunity?

Nvidia’s Exit Sends SoundHound AI (SOUN) Into a Tailspin

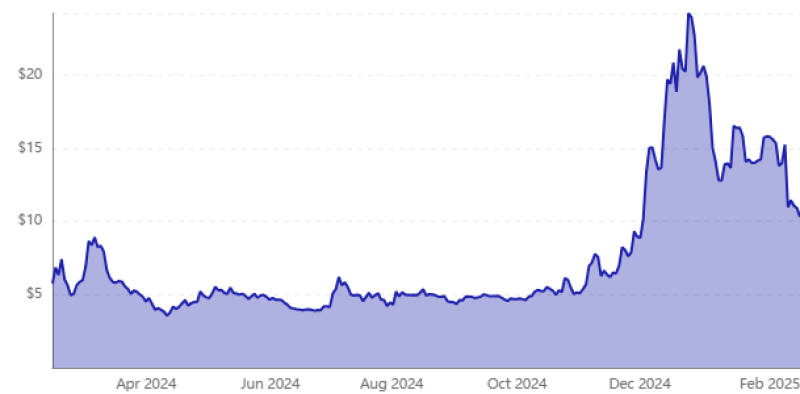

SoundHound AI (SOUN) experienced an impressive 883% rally in 2023, but the stock has now fallen around 55% from its December peak. The latest catalyst for the drop was Nvidia, which revealed in a regulatory filing that it had sold its entire stake in SoundHound AI.

Nvidia had initially invested in SoundHound AI in 2017 as part of a $75 million financing round. A February 2024 disclosure of its holdings provided a bullish boost to SOUN stock, but its complete exit has had the opposite effect. Investors interpreted Nvidia’s move as a lack of confidence in SoundHound AI, despite the absence of any negative remarks from Nvidia regarding the company.

SoundHound AI (SOUN) Revenue Surges Despite Market Jitters

Despite the sharp decline in stock price, SoundHound AI’s financials remain strong. In Q3 2024, the company posted record revenue, surging 89% year-over-year. The revenue mix has also improved, with its largest customer now accounting for only 12% of total revenue, compared to 72% a year earlier.

The company has diversified its client base beyond the automotive industry. By Q3 2024, revenue contributions were more balanced across multiple sectors, including:

- Automotive

- Restaurants

- Financial services

- Healthcare

- Insurance

This diversification reduces risk and strengthens SoundHound AI’s long-term growth prospects.

SoundHound AI (SOUN) Faces Challenges Despite Growth Potential

While SoundHound AI has promising growth opportunities in the voice AI market, estimated to be worth at least $140 billion, significant challenges remain:

- Lack of profitability: The company continues to operate at a loss.

- Intense competition: Several larger players in the AI space have deeper financial resources.

- High valuation: Even after the recent drop, SOUN stock trades at nearly 50 times sales, making it an expensive bet.

Is SoundHound AI (SOUN) Stock a Buy After the Nvidia Sell-Off?

The investment thesis for SoundHound AI remains largely unchanged despite Nvidia’s exit. The company still has strong revenue growth, expanding market opportunities, and a diversified customer base. However, risk-averse investors may want to steer clear due to ongoing volatility and financial concerns.

For aggressive investors willing to tolerate risk, SOUN stock could present an intriguing opportunity at its lower valuation. If SoundHound AI can execute its growth strategy and outpace the competition, it has the potential to reward long-term investors.

Conclusion

While Nvidia’s decision to sell its stake triggered a sharp decline in SOUN stock, the core fundamentals of SoundHound AI remain intact. Investors should weigh the risks and rewards carefully before making a decision.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah