Something's shifting in the silver market. The cost to short the iShares Silver Trust (SLV) just went through the roof, and the number of shares available to borrow has practically disappeared. These moves suggest the ETF is under real strain, and volatility could be coming.

Key Developments

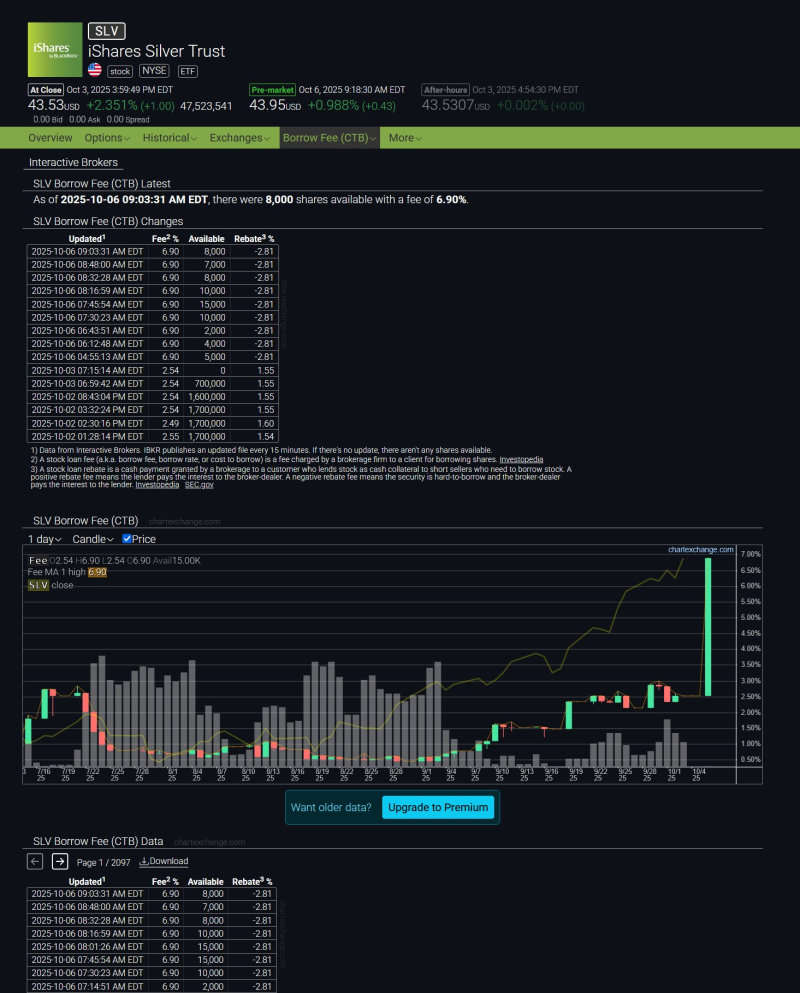

According to a recent observation from Bob Coleman on social media, SLV's borrowing dynamics changed dramatically overnight. The cost-to-borrow rate jumped to 6.90%—nearly triple what it was a week ago—while available shares fell to just 8,000. For traders looking to short the silver ETF, it's become both expensive and nearly impossible.

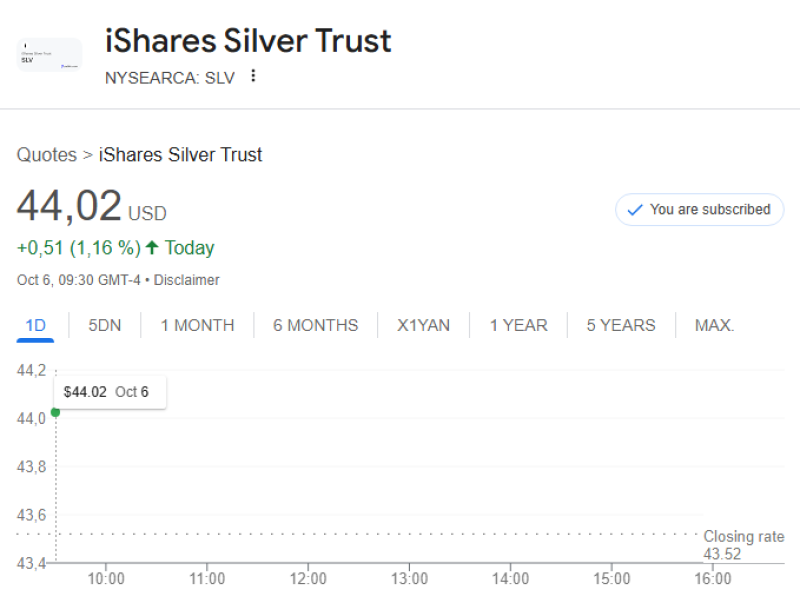

The data tells a compelling story. Borrow fees shot up from around 2.5% to almost 7% in a matter of days. With fewer than 10,000 shares left to borrow, short sellers are essentially running out of ammunition. Meanwhile, SLV itself closed at $43.53 on October 3rd, gaining 5.7% in a single session, with pre-market action showing continued strength. Historically, spikes like this in borrowing costs tend to show up right before options markets get choppy, as traders scramble to hedge or bet on big swings.

Rising borrow fees act like a hidden tax on anyone betting against silver. They signal both scarcity and demand. If authorized participants start redeeming SLV shares for physical metal in this environment, the squeeze could get tighter and push prices even higher. Add in growing industrial use and renewed interest in precious metals as protection against inflation, and you've got the ingredients for serious price movement.

What's Next

With borrowing costs tripling and share availability at historic lows, SLV sits at an inflection point. Traders should expect heightened volatility in the near term. Whether this marks the beginning of a genuine short squeeze or just temporary market stress remains to be seen—but either way, the silver market is worth watching closely right now.

Peter Smith

Peter Smith

Peter Smith

Peter Smith