Aerospace and defense company RTX saw its stock tumble despite maintaining its annual guidance, as management revealed potential tariff impacts that could significantly affect operating profits.

RTX First-Quarter Earnings Remain Solid Despite Market Reaction

RTX's first-quarter earnings report released today contained no negative surprises, and the company maintained its full-year guidance. Management continues to expect organic sales growth of 4%-6%, with adjusted earnings per share (EPS) of $6.00-$6.15, and free cash flow (FCF) between $7 billion and $7.5 billion for the year.

Despite these stable projections, RTX shares dropped 10.5% by 1:30 p.m. ET, even as broader markets rallied. The significant decline came as a shock to many investors who had anticipated a positive reaction to the maintained guidance.

RTX Reveals Substantial Tariff Impact on Operations

The market's negative reaction was primarily driven by management's estimates regarding potential tariff impacts. These revelations proved particularly concerning when considering that RTX's adjusted operating profit was approximately $10.2 billion in 2024.

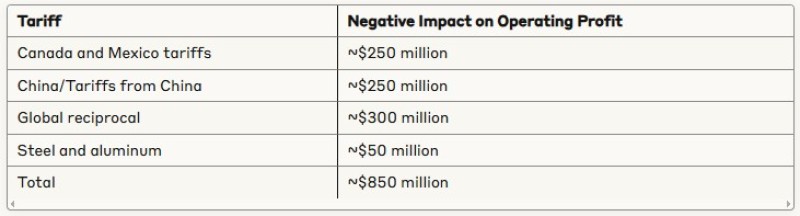

According to the company's presentation, the cumulative negative impact on operating profit could reach approximately $850 million. This breaks down as follows:

RTX Faces Additional Challenges Beyond Initial Estimates

The situation appears even more concerning when considering additional factors. Management clarified that these estimates already include mitigating actions they plan to take to reduce the impact. This suggests that the raw impact of the tariffs could be even higher before these mitigating measures.

Further compounding the issue, CFO Neil Mitchill informed investors during the earnings call that "the cash flow impact would be a bit larger" due to anticipated delays in receiving refunds on duties paid. This additional cash flow pressure creates another layer of concern for investors analyzing the company's near-term prospects.

The combined effect of these tariff impacts represents approximately 8.3% of RTX's adjusted operating profit, explaining why investors reacted so strongly to the news, despite the company maintaining its overall guidance.

RTX Potential Upside if Trade Conflicts Resolve

Despite the immediate negative market reaction, there could be a silver lining for patient investors. The $850 million tariff impact now priced into the stock potentially represents upside if there's a resolution to ongoing trade conflicts. Given that all parties involved have expressed desire for resolution, this situation creates an interesting dynamic for investors to monitor.

The current stock price adjustment might create an opportunity for those who believe in the company's long-term prospects and anticipate the eventual resolution of these trade tensions. However, investors will need to carefully weigh these potential upsides against the near-term headwinds the company faces.

In the meantime, RTX must navigate these challenging trade conditions while continuing to execute on its core aerospace and defense business strategies. Management's ability to mitigate these tariff impacts will likely be a key focus of investor attention in upcoming quarterly reports.

As global trade tensions continue to evolve, RTX's significant exposure to international markets makes it particularly vulnerable to policy shifts. Investors considering a position in RTX should carefully monitor developments in trade negotiations between the U.S. and key trading partners, including Canada, Mexico, and China, as these will directly impact the company's profitability in the coming quarters.

Usman Salis

Usman Salis

Usman Salis

Usman Salis