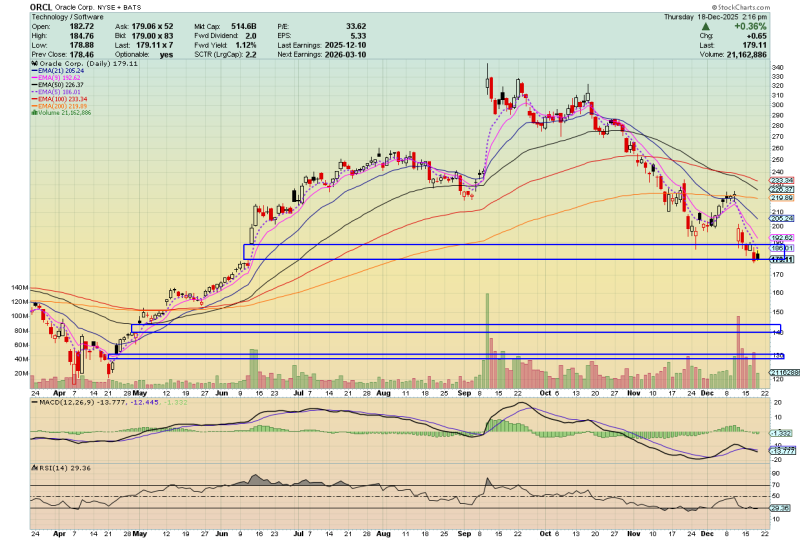

⬤ Oracle Corp. (ORCL) is struggling to find its footing, with the stock hovering around the $175–$180 zone after tumbling from over $300 earlier this year. Price action shows the stock stuck near a crucial support level, but buyers haven't shown up in any meaningful way. The technical picture keeps getting worse, with the stock failing to hold any bounces or generate real buying interest.

⬤ Looking at the chart, ORCL sits below several declining moving averages, painting a clearly bearish picture. The stock shifted from a strong uptrend earlier in 2024 into a pattern of lower highs and lower lows that just won't quit. The RSI indicator is creeping into oversold territory, but that's not enough to signal a turnaround yet. Volume patterns during recent selloffs suggest sellers are still in control rather than exhausted.

⬤ What's particularly concerning is that Oracle didn't catch any momentum from Micron Technology's moves, showing this isn't just a sector-wide problem. While other tech and semiconductor stocks have managed to bounce, Oracle remains pinned down near long-term support. This isolation from broader tech strength continues weighing on sentiment and keeping pressure on the stock.

⬤ The current setup matters because Oracle is a heavyweight in enterprise software with serious index presence. If the stock can't hold around these levels, it could drag down sentiment across the software sector. Right now, ORCL is sitting at a make-or-break point—either it stabilizes here and builds a base, or it breaks down and extends the downtrend that's been grinding lower for months.

Usman Salis

Usman Salis

Usman Salis

Usman Salis