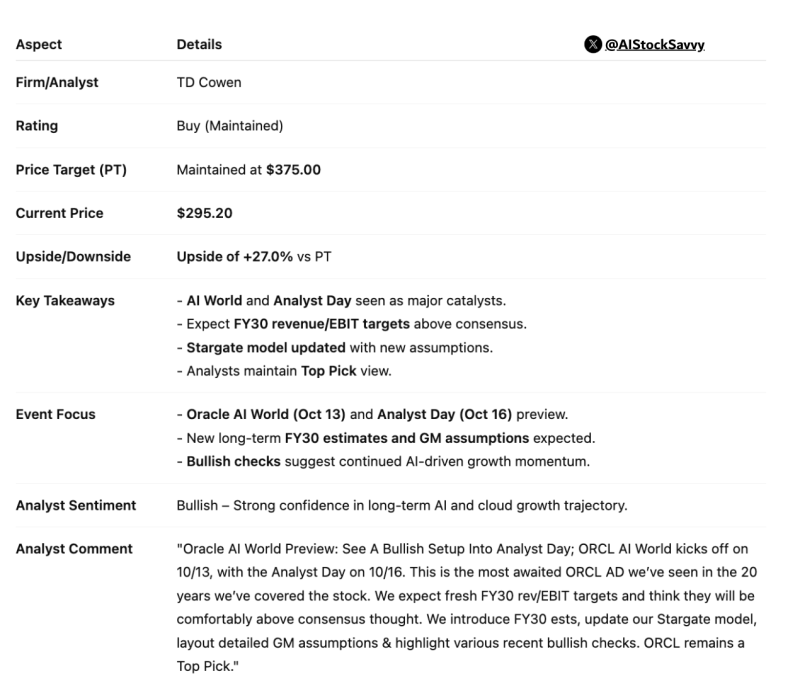

Oracle (ORCL) continues to attract investor interest as it gears up for two major events—AI World on October 13 and Analyst Day on October 16. TD Cowen has reaffirmed its Buy rating with a $375 price target, representing nearly 27% upside from the current price of around $295. These upcoming events are expected to shed light on Oracle's cloud and AI strategy, with analysts anticipating guidance that could surpass market expectations and validate the company's momentum in AI-driven enterprise solutions.

Key Analyst Insights

Analyst Hardik Shah points to several factors supporting the optimistic outlook. The AI World and Analyst Day events will showcase Oracle's AI infrastructure and provide clarity on its financial direction.

New FY30 revenue and EBIT projections are likely to exceed Street consensus, reinforcing confidence in the company's long-term trajectory. TD Cowen has updated its "Stargate" financial model with revised assumptions and continues to rank Oracle as a Top Pick, emphasizing the company's strong position in AI and cloud markets.

Market Context and Price Action

Oracle shares are trading near $295.20, holding steady after recent gains. The stock shows resilience and solid support levels, suggesting institutions remain confident ahead of the catalyst events. The $375 target implies significant upside potential. If management delivers stronger-than-expected AI guidance during the upcoming presentations, the stock could gain fresh momentum and test new resistance zones.

AI as the Growth Engine

Oracle's competitive edge comes from embedding AI directly into its cloud infrastructure, positioning it alongside giants like Microsoft and Amazon in the enterprise space. As AI adoption accelerates across industries, Oracle's growing cloud presence and strategic partnerships are expected to fuel sustained growth through the next decade.

Peter Smith

Peter Smith

Peter Smith

Peter Smith