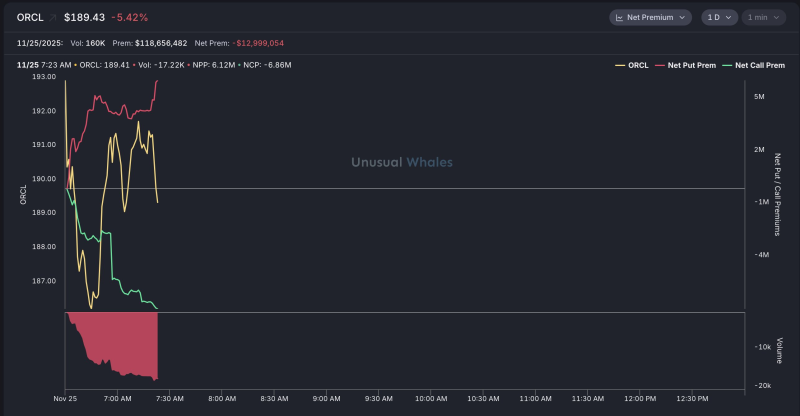

⬤ Oracle (ORCL) dropped more than 5 % and reached its lowest price in five months. The stock opened near $189 plus fell immediately, which caused a surge in put option trades and showed that traders turned markedly negative.

⬤ Options data left no doubt about the bearish mood. Net put premium rose fast, while call premium fell deeper below zero, which meant traders either protected holdings or bet outright against Oracle's short term outlook. “The steady imbalance shows sentiment is getting worse,” but also it underlined how lopsided the trading turned.

⬤ The stock found no support for the rest of the day. Call buyers stayed away and put volume kept rising - the selling pressure stayed obvious. With the price at five month lows as well as options flow skewed hard to the bear side, Oracle now faces a difficult technical picture as the next sessions begin.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi