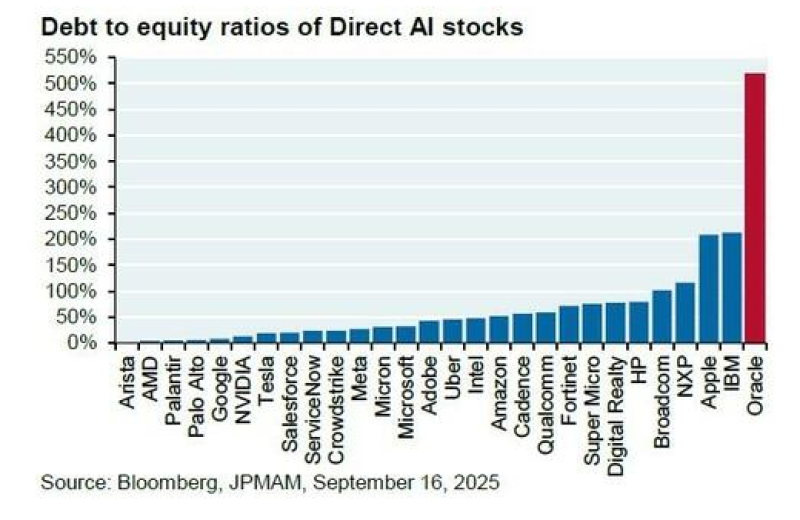

The AI race is heating up, but one company's balance sheet is flashing warning signs. Recent data from Bloomberg and JPMAM shows Oracle (ORCL) carrying a staggering debt-to-equity ratio above 500%, the highest among major AI stocks. While rivals like Nvidia, Microsoft, and Amazon continue expanding AI infrastructure with moderate leverage, Oracle's debt load now towers over the sector, raising investor concerns about the sustainability of its aggressive capital strategy.

Chart Analysis: Oracle's Debt Tower Dominates the AI Sector

A chart shared by Barchart trader ranks over 20 publicly traded AI-related companies by their debt-to-equity ratio, and the contrast is striking: Oracle sits above 500%, far exceeding all peers; IBM comes next at around 250%; Apple and Broadcom fall between 150-200%; and most others, including Nvidia, Microsoft, and Google, remain below 50%.

The data highlights Oracle as an extreme outlier in corporate leverage among "Direct AI" players. Even hardware-heavy firms like Nvidia and AMD, which require substantial capital for chip production, operate with far more conservative debt structures. This imbalance suggests Oracle's AI and cloud expansion has been heavily debt-financed, reflecting both ambition and significant financial exposure.

Why Oracle's Leverage Is So High

Oracle's rising debt aligns with its rapid shift toward AI cloud infrastructure and large-scale GPU data centers. Over the past two years, the company has invested billions in expanding Oracle Cloud Infrastructure (OCI) to support AI workloads, partnering with Nvidia and Cohere to deliver enterprise-grade AI models, financing data center construction through bond issuances and long-term loans, and absorbing debt from its Cerner healthcare technology acquisition.

While these moves have elevated Oracle's profile in the AI ecosystem, they've also ballooned debt levels to a point where interest expenses will likely weigh on future margins, especially if rate cuts remain limited through 2026.

Investor Sentiment and Peer Comparison

The market remains divided. Optimists argue that Oracle is leveraging for AI leadership, betting that early dominance in AI cloud services will offset current financial strain. Skeptics warn that the company's balance sheet risk is amplified at a time when borrowing costs remain high and competition intensifies.

The comparison is telling. Microsoft and Amazon continue funding AI and cloud growth primarily through free cash flow. Nvidia remains nearly debt-free thanks to record chip revenues. IBM, while also carrying debt, maintains a more balanced profile with steady service cash flows. Oracle's uniquely high leverage stands out as a double-edged sword, enabling aggressive expansion but amplifying financial vulnerability.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi