⬤ Oracle Corporation drew sharp scrutiny after its latest balance sheet showed the company has taken on heavy borrowings. Total debt stands near $127 billion, of which about $25 billion matures within three years. Observers now question whether Oracle has enough room to meet those obligations while its cash flow offers little help.

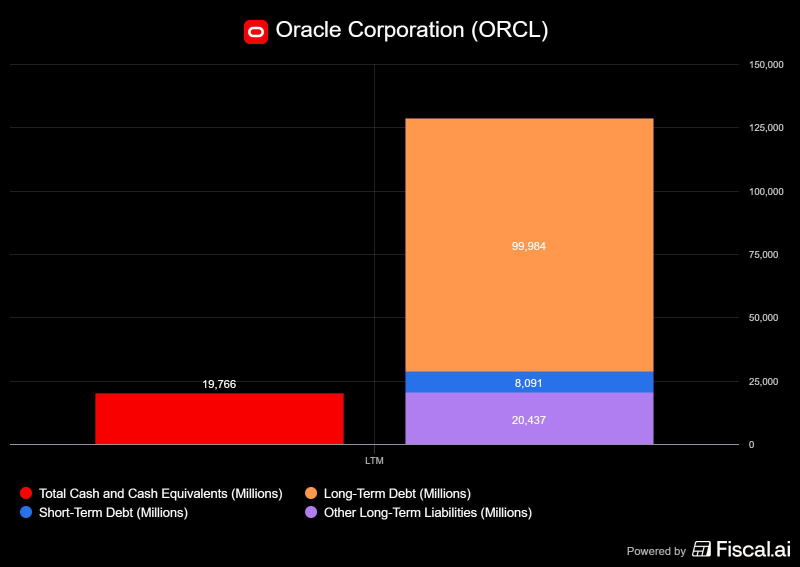

⬤ The company holds roughly $19.8 billion in cash and cash-like assets - that figure looks small beside $127 billion in debt. Long-term borrowings account for around $100 billion, short term debt adds $8.1 billion and a further $20.4 billion falls under other long term liabilities. Total liabilities therefore approach $130 billion plus investors want to know how management intends to handle the burden.

The size of Oracle's debt together with long running negative cash flow complicates any refinancing, one market analyst said, especially while interest rates stay high and lenders become pickier.

⬤ Cash flow adds pressure. During the last twelve months Oracle consumed about $13 billion in free cash. Analysts predict the metric will not turn positive until 2028 at the earliest, since large outlays for data centres and daily operations will keep eroding liquidity. The strain became serious enough that one counter party, $OWL, is said to have walked away from a transaction after reviewing Oracle's finances.

⬤ For anyone holding ORCL shares the outlook is awkward. Refinancing the debt will be expensive while rates remain elevated but also with cash flow recovery still multiple years off Oracle has limited flexibility. The firm is pressing ahead with cloud expansion and enterprise services - its ability to meet near term debt payments while restoring positive cash flow will decide how the market prices the stock.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi