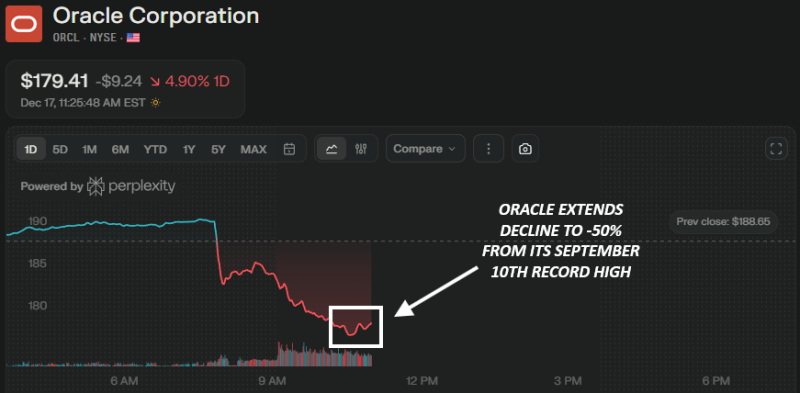

⬤ Oracle Corporation (ORCL) lost another five percent in the latest session and now trades about half of the price it reached on 10 September. The shares slid from roughly one hundred eighty nine dollars to one hundred seventy nine erasing the strong run that had made the stock one of the sector's early year leaders. The intraday chart shows an even slide that never paused - no rebound appeared.

⬤ The drop is ugly because it refuses to stop. Since the September peak every attempted bounce has died within hours leaving a staircase of lower highs that invites new selling. Volume during the latest plunge was far above normal, a sign that large holders are leaving, not just day traders.

⬤ Credit investors are also uneasy. A widely watched credit-default-swap quote on Oracle debt has reached its highest level since the 2009 crisis. That price rise means the cost of insuring against a default has jumped - professional bond managers are now demanding extra protection. When both the share price and the cost of default insurance fall together, the message is blunt - lenders and equity owners are losing confidence at the same moment.

⬤ Oracle's pain reaches beyond one ticker. The company is a core holding for pension funds, index trackers and large mutual funds. A fifty percent decline in a benchmark name, paired with flashing credit signals, pushes portfolio managers to question the value of similar large tech positions. Expect the selling pressure to spill into peer stocks and to add another dose of turbulence to the technology group.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah