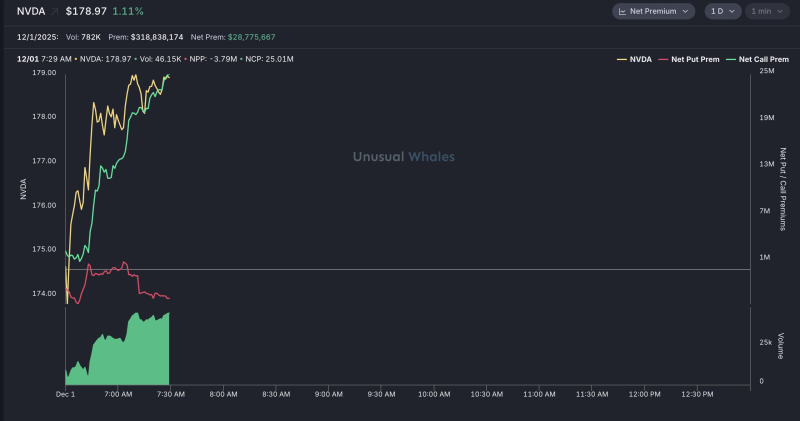

⬤ Nvidia extended its recent run in early trading, with the share price rising 1 % to 178.97. The gain matched a surge in options activity recorded on the Unusual Whales platform, where traders saw large premium flows arrive shortly after the opening bell. The stock moved steadily from about 174 - 179 as call buyers became more active during the first part of the session.

⬤ The figures speak plainly. By the snapshot time, Nvidia had accumulated about 318.8 million dollars in total options premium, with net call premium at roughly 25 million dollars. Put premium stood near negative 3.8 million dollars indicating that traders held a strong bullish bias early in the day. The price chart mirrored that bias - NVDA climbed while call volume grew. Over 46,000 contracts had traded by 7:29 a.m. showing how closely traders were watching Nvidia during those opening minutes.

⬤ The chart showed the sentiment divide. Call premium rose sharply throughout the opening period, while put premium stayed flat and quiet, a sign that traders saw little downside risk. That balance helped NVDA push firmly through the mid-170s. The mix of heavy premium flows and steady upward movement illustrates how Nvidia keeps drawing focused trading interest, particularly in options, where positioning can drive intraday momentum.

⬤ Nvidia's early strength and the one sided premium flows reflect the wider excitement around semiconductor besides AI stocks. NVDA stays among the most actively traded names and when options positioning shifts, it can sway short term sentiment. Traders who want to see whether demand holds will watch for either continued call pressure or a reversal in premium flows, since either outcome could alter intraday volatility and the broader mood toward high growth technology stocks.

Peter Smith

Peter Smith

Peter Smith

Peter Smith