Options trading can reveal what the smart money thinks about where stocks are headed. On October 17, someone made a bold $9.1 million bet on Nvidia (NVDA) by selling put options - a move that screams confidence the stock won't tank anytime soon. Even with tech stocks bouncing around lately, this trade shows big players still believe in Nvidia's staying power.

Major Options Trade Spotted

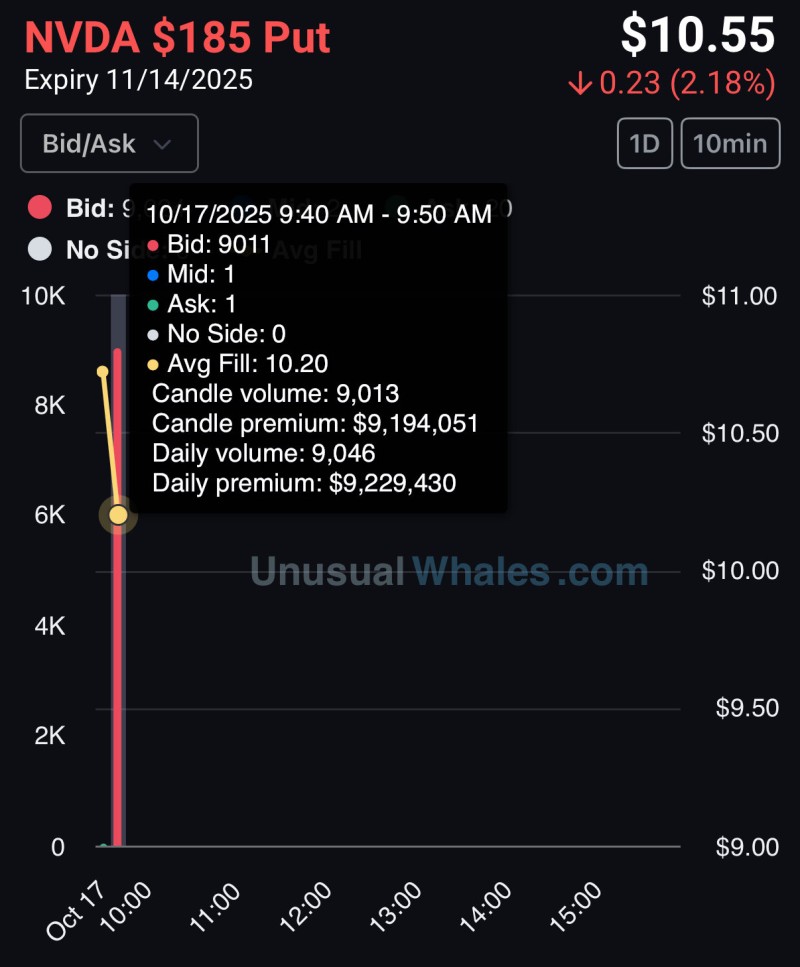

Data from Flow God shows over 9,000 contracts of the $185 put expiring November 14, 2025 got sold at around $10.20 each, pulling in more than $9.1 million in premium.

When traders sell puts on this scale, they're essentially saying "we don't think this stock's going below $185." It's a bullish play that banks on Nvidia holding strong as AI and chip demand keeps growing. This kind of positioning matters because it shows institutional money managers see limited downside and are happy to pocket premiums while betting on Nvidia's market leadership.

What the Charts Tell Us

The trading chart caught a massive volume spike during the morning session when most of these contracts changed hands. Even though prices jumped around a bit, the option held steady near $10.50, showing consistent buyer interest. The standout details: over 9,000 contracts moved in less than 10 minutes, prices stuck above $10 showing solid demand, and the sheer size of this put sale points to expectations that NVDA won't crater below $185.

Why Investors Should Care

Nvidia's become the poster child for AI investing, with its GPUs running everything from ChatGPT to cutting-edge data centers. Sure, the stock's had its wild days thanks to sky-high valuations and jittery markets, but this options flow tells us something important—the big money still sees Nvidia as the long-term winner in AI infrastructure.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah