Nvidia (NVDA) stock experiences a significant selloff, creating an attractive valuation point for investors despite regulatory challenges in the AI chip market.

NVDA's Surprising Market Position

Nvidia Corporation (NVDA) has caught the attention of financial analysts after a notable stock decline that has pushed its valuation to intriguing levels. Despite an 8.7% drop in Monday trading and a 15% decline year-to-date, Bernstein analyst Stacy Rasgon sees this as a potential opportunity for investors.

Valuation Metrics Reveal Unique Opportunity

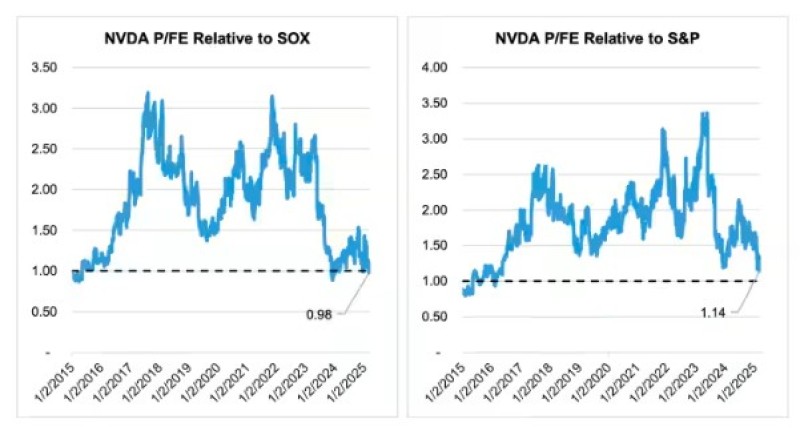

The stock is now trading at a particularly interesting position in the market. Notably, NVDA is currently trading at just a "slight premium" to the S&P 500, which is its lowest premium since 2016. Even more remarkable is its position relative to the PHLX Semiconductor Index, where it's trading "below parity" - a scenario that has occurred only once or twice in the past decade.

Key valuation metrics paint a compelling picture:

- Forward earnings multiple of approximately 25 times

- Lowest multiple in a year

- Near-decade-low valuation points

Blackwell Product Cycle Promises Growth

The timing of this valuation dip is particularly interesting, especially as Nvidia enters a new product cycle. The company has already shipped $11 billion worth of Blackwell products last quarter, with expectations of continued momentum. Rasgon suggests that "the floodgates are now open" for this new product line, despite some initial challenges.

Regulatory Challenges Loom

A potential cloud on the horizon is the emerging regulatory landscape. The Biden administration recently implemented new restrictions on AI-chip sales to China, with full implementation expected in May. This has created some uncertainty in the market, particularly regarding potential future restrictions.

Rasgon argues that further restrictions, such as an H20 ban, would be counterproductive. He believes such a move would "simply hand the Chinese AI market to Huawei" and notes the complexity of navigating these geopolitical challenges.

Investment Outlook Remains Positive

Despite the current sentiment shift in the AI sector, Rasgon remains optimistic. He points out that:

- Spending intentions continue to rise

- A new product cycle is just beginning

- The upcoming GPU Technology Conference (GTC) could provide additional insights

The analyst maintains an "outperform" rating on NVDA with a target price of $185, describing the current stock valuation as "increasingly attractive."

Investor Takeaway

While short-term volatility exists, Nvidia's strong market position in AI chips and its attractive valuation suggest potential long-term value. Investors should carefully monitor regulatory developments and the upcoming product cycle.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah