⬤ The semiconductor sector has seen a dramatic leadership change over the past year, with equipment manufacturers leaving NVDA Nvidia in the dust. While Nvidia still sits higher in absolute terms, the performance gap tells a compelling story about how money is rotating through different parts of the chip ecosystem—moving away from fabless designers toward companies that build the actual manufacturing tools.

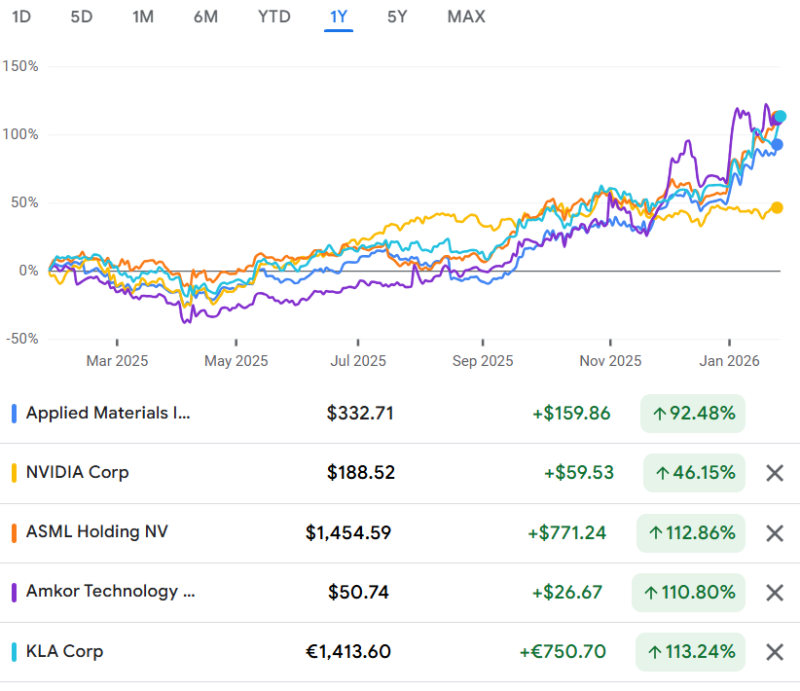

⬤ The numbers are striking. Applied Materials jumped roughly 92% over the past year, while ASML Holding, KLA Corp, and Amkor Technology each soared more than 100%. Meanwhile, NVDA Nvidia managed about 46% gains during the same stretch. That's a massive disparity showing how capital flowing into fabrication equipment, process control, and back-end manufacturing has translated into stronger stock performance for semicap companies.

⬤ This rotation reflects where the semiconductor cycle is heading. The pattern shows semicap stocks accelerating during periods when NVDA's performance cooled off compared to earlier cycle stages. What started with fabless designers has methodically shifted through energy segments, then equipment makers, and now toward raw materials suppliers.

⬤ For the broader tech market, this matters because it shows how leadership within semiconductors constantly shifts based on where investment dollars concentrate along the supply chain. NVDA remains the go-to reference for chip design and AI exposure, but these performance trends prove that different segments can dominate depending on the cycle phase. As this evolution continues, watching how leadership rotates between fabless, equipment, and materials segments could be key for understanding sector momentum and volatility across global markets.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah