Something interesting is happening with NIO's mass-market brand ONVO. The newly launched L90 has become the brand's star performer in just two months. Since hitting the market in August 2025, the L90 has grabbed the majority of ONVO's deliveries, completely reshaping the brand's lineup dynamics and showing that this vehicle launch has serious legs.

L90 Takes Command as ONVO's Growth Engine

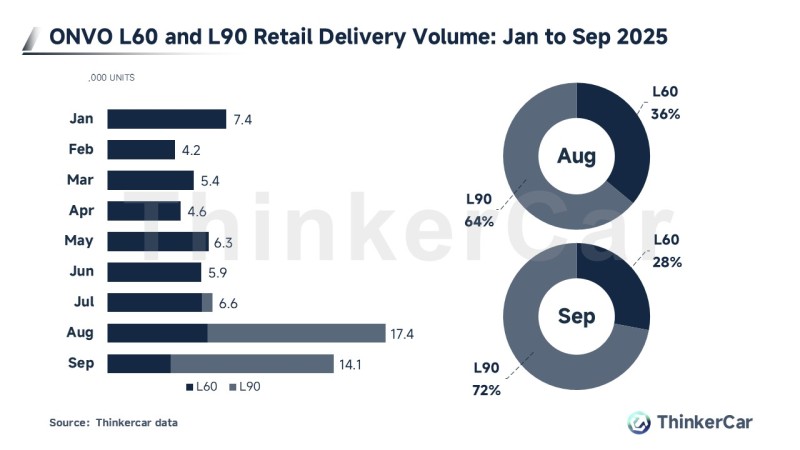

According to retail delivery data compiled by ThinkerCar, the numbers from January through September 2025 tell a pretty dramatic story. For the first seven months of the year, ONVO's volumes stayed relatively steady between 4.2K and 7.4K units, with the L60 carrying almost all of that weight.

Then August hit, and everything changed. With the L90's arrival, total deliveries jumped to 17.4K units, followed by 14.1K in September. The L90's share went from 64% in August to 72% in September, while the L60 slipped to just 28% of the mix. It's clear the L90 didn't just join the lineup—it took over.

Why the L90 Is Leading the Charge

There are a few reasons why this shift happened so quickly: product cycle momentum, broader market reach, and sales network synergy. As ONVO's newest release, the L90 rode a wave of buzz, pre-orders, and early promotions that helped it capture attention fast. It also expands ONVO's range into a higher-tier segment, giving buyers more options beyond the mid-size L60—which probably explains why August and September saw such strong overall growth. Plus, ONVO's connection to NIO's retail and service network seems to be paying off. The speed of the delivery ramp suggests production and logistics were locked in well before launch day.

Chart Context: Strong August and September Momentum

The data makes the transition crystal clear. In August, the L90 grabbed 64% of total deliveries. By September, that climbed to 72%, while the L60 dropped from 36% to 28%. But it's not just about one model eating into another—the monthly delivery totals show genuine growth. ONVO's output improved dramatically after July, meaning the L90 brought in new demand rather than simply replacing L60 sales.

What Investors Should Watch

While ONVO's trajectory looks solid, there are still some big questions ahead. Can the L90 keep up this momentum through Q4 once the early wave of buyers moves on? Will its popularity support or hurt L60 demand going forward? And what about profitability—larger, higher-spec models like the L90 could boost margins, but only if production costs don't eat into those gains. For NIO ($NIO), ONVO's rapid shift could become a real positive if it holds. It would validate the company's multi-brand approach and give it a stronger position in China's crowded EV market.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov