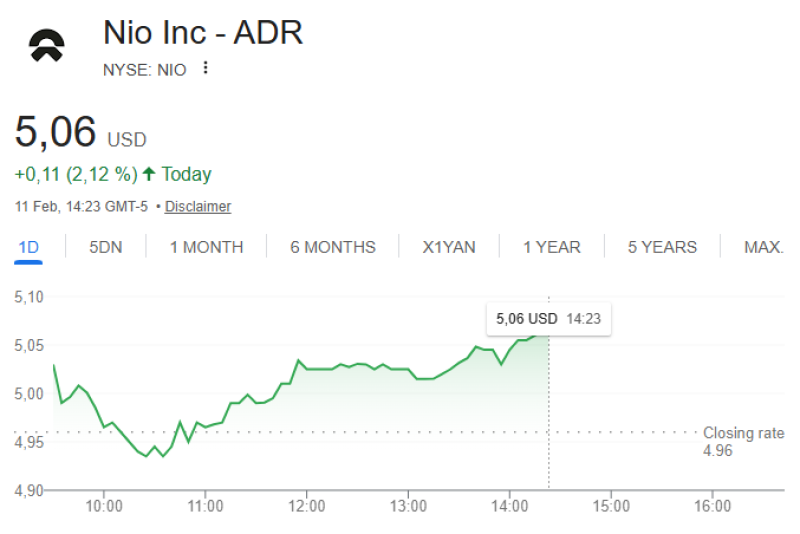

⬤ Nio Inc. (NIO) pushed back above the $5 mark, putting a critical technical level in focus. What matters now is the 200-day moving average sitting around $5.19 - breaking through and holding it as support would signal a real shift toward an uptrend.

⬤ The chart shows NIO reaching about $5.06 after previously trading below that threshold. Getting back above $5 puts the stock right under that long-term moving average resistance, creating a make-or-break zone. We've seen this pattern before with NIO - NIO stock shows signs of reversal and NIO price rebounds off key support situations where reclaiming resistance determined what came next.

⬤ The key here is confirmation—price needs to break above $5.19 and then actually find support there. Without that acceptance, this is just a bounce, not a trend change. Moving averages have a track record of influencing momentum in NIO bullish setup targets higher prices scenarios.

⬤ If the breakout happens and support forms, there's talk of $12 as a potential target level down the road. But right now, everything depends on whether NIO can flip that 200-day moving average from resistance into support. Until that happens, traders are watching and waiting.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova