● NIO has evolved significantly from its volatile early days. As Pax put it: "This is not the same #NIO as before. It's a whole new game." With investors getting savvier about manipulation and the company's fundamentals improving, NIO may be entering a new chapter where market perception finally catches up to reality. This sentiment shift could attract steadier capital and support the company's long-term EV ambitions.

● The analysis indicated that institutional players had already loaded up during the recent dip and were now ready to scoop up shares from panicked retail sellers. The blunt take: those who sold out of fear missed the point—NIO today isn't the same struggling startup from years past.

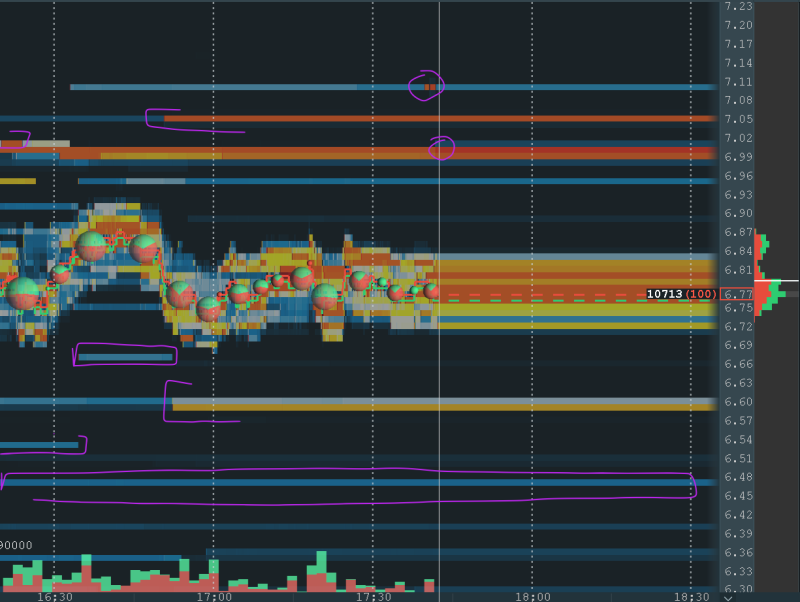

● The manipulation playbook is familiar. Algo spoofing amps up volatility, shakes out nervous retail holders, and triggers stop-losses. But something different happened this time. Many traders didn't take the bait. That shift hints at maturing investor psychology around NIO, which could mean fewer panic cascades and better price stability going forward.

● Looking at the charts, volume spikes clearly came from institutional activity, not retail panic. While these tactics muddy market transparency, they also reveal confidence from deep-pocketed players building positions on weakness. If this accumulation continues, it could give NIO's stock a more solid floor as the company pushes ahead in the competitive EV space.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova