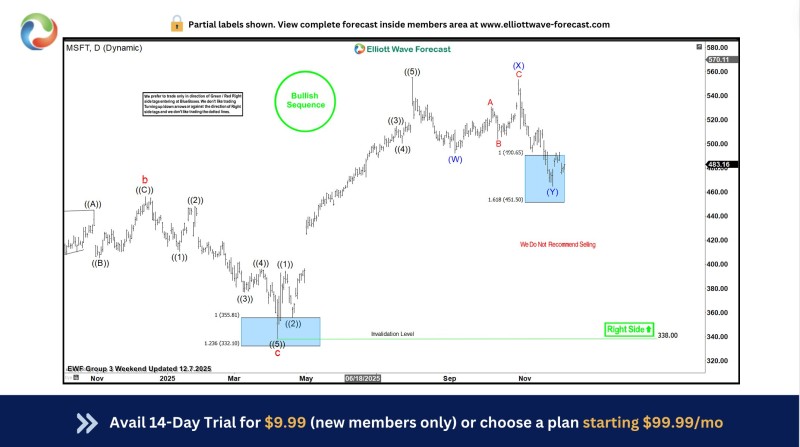

⬤ Microsoft showed signs of stabilizing after reaching the support area highlighted in the Elliott Wave structure, where the stock may have wrapped up its latest correction. MSFT now looks set for a rebound scenario, with expectations of a short-term move higher as long as dips hold above the $451.50 low. The chart shows a clear corrective pattern leading into this region, suggesting Microsoft has entered a zone where technical models point to stronger odds of a bullish reaction.

⬤ The decline into the support area between Fibonacci levels near $490.65 and $451.50 marks a region that lines up with the forecasted end of the corrective structure. Within this zone, MSFT is forming a bounce, supported by the overall bullish sequence indicated on the chart. The wave labeling shows the transition from a prior high into a structured pullback, with the support box acting as a potential pivot point. The forecast projects a rebound toward the $502.40 to $525.10 range, offering a clear upward target based on the current wave count.

⬤ The corrective phase appears to have run its course, with early signs of upward momentum starting to emerge. The chart also notes that selling isn't recommended within this structure, which aligns with expectations that the prevailing trend may pick back up once the reaction from the support zone strengthens. MSFT has stayed above the critical $451.50 level, which serves as the key threshold for validating the rebound scenario. Price consolidation within the zone backs up the technical case for a short-term recovery, while the invalidation level at $338 provides a broader structural boundary.

⬤ This development matters because Microsoft plays a major role in overall market sentiment and index performance, and shifts in its wave structure can shape broader trend expectations. A sustained rebound from the support area would support the continuation of the bullish sequence shown on the chart, while a breakdown below the defined support would signal changing dynamics. The current setup puts MSFT at a notable turning point as market participants watch to see whether the anticipated bounce builds momentum.

Peter Smith

Peter Smith

Peter Smith

Peter Smith