Meta Platforms' latest financial trend has caught the attention of Wall Street analysts. The tech giant, once holding tens of billions in net cash, has now slipped into negative territory. This shift reveals how Meta's aggressive shareholder rewards, combined with heavy infrastructure spending, have outpaced even its impressive ability to generate cash.

Meta's Cash Position Falls Below Zero

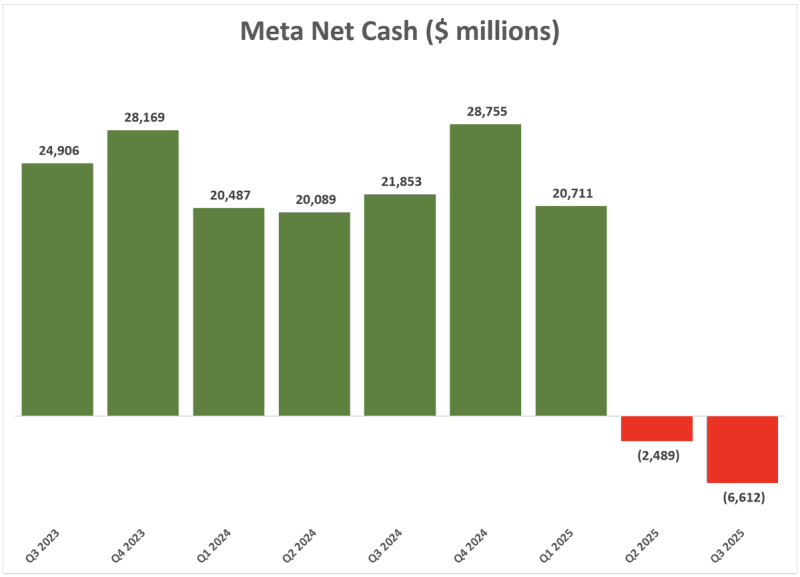

The numbers tell a striking story. Investor Marcelo P. Lima recently shared data showing a dramatic reversal in Meta's balance sheet. After hitting a peak of $28.7 billion in Q4 2024, the company's net cash position fell steadily through 2025, bottoming out at -$6.6 billion by Q3.

In just three quarters, Meta burned through nearly $35 billion in cash reserves. This marks the first time the company's debt has exceeded its cash on hand. What makes this particularly interesting is that it didn't happen because business slowed down. Meta still generates roughly $45 billion in annual free cash flow. The issue is how aggressively they're spending it.

Where the Money Is Going

Meta's cash drain comes down to one thing: they're returning more money to shareholders and employees than they're taking in. Looking at the trailing twelve months, the spending breakdown is substantial:

- $29 billion on share buybacks, reflecting Mark Zuckerberg's effort to prop up the stock price and offset dilution from employee compensation

- $16 billion covering taxes on equity compensation tied to employee stock awards

- $5 billion in dividends, a relatively new program designed to attract institutional investors

Add it all up, and you're looking at about $50 billion going out the door annually. That's $5 billion more than what's coming in from operations. The result? A net cash deficit, even while the company posts record profits.

Meta's decision to prioritize these capital returns comes at a time when they're also pouring money into AI infrastructure, data centers, and custom chip development. These investments are critical if Meta wants to stay competitive long-term, but they're expensive. Then there's Reality Labs, the metaverse division that continues bleeding billions every quarter. Meta seems to be betting that its advertising business and AI capabilities will grow fast enough to fund both the innovation pipeline and generous shareholder returns. But the latest numbers suggest there's a trade-off happening. To keep up the buybacks and dividends, Meta may need to lean more heavily on debt financing. That's a significant shift for a company that's historically kept a very conservative, cash-heavy balance sheet.

What This Means for Investors

Meta moving into net debt isn't a crisis. The company still generates strong cash flow and has access to cheap credit. But the speed at which their cash cushion disappeared is notable. It signals a strategic turning point. The balance sheet shift exposes the tension between rewarding shareholders in the short term and funding the massive AI-driven reinvestment the company needs for the future. For investors, the question is whether Meta can keep up its ambitious capital return program while simultaneously funding the next generation of AI infrastructure and product development.

Usman Salis

Usman Salis

Usman Salis

Usman Salis