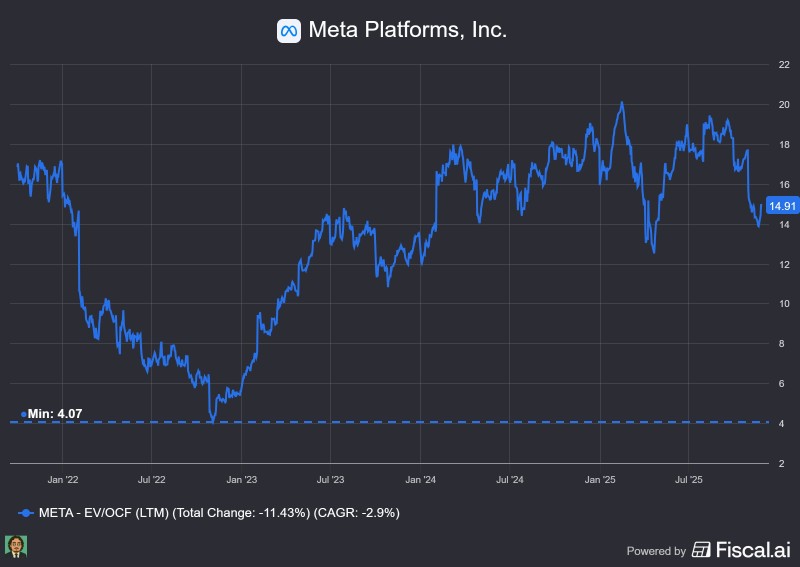

⬤ Meta Platforms is facing fresh pressure as its enterprise value to operating cash flow ratio trends downward. The pullback has investors wondering if Meta's valuation could revisit earlier lows, with the metric now hovering near 14.9 after a period of steady decline.

⬤ Looking at Meta's EV/OCF ratio over the past few years, the metric hit a bottom around 4.07 during 2022's downturn. From there, it climbed throughout 2023 and into 2024, reaching the upper teens and briefly crossing above 20. But recent months show the ratio giving back those gains, with an overall drop of 11.43 percent and a compound annual decline of 2.9 percent. While Meta's cash flow performance bounced back strongly after 2022, the valuation multiple isn't holding up.

⬤ The current 14.91 reading puts Meta back in the middle of its three-year range. The company has been through several expansion and contraction cycles, reflecting shifting expectations around cash flow strength and revenue growth. Whether this slide continues depends largely on market conditions and Meta's ability to keep operating cash flow moving higher despite competition and economic headwinds.

⬤ As a major tech heavyweight, Meta's valuation shifts tend to ripple across the growth stock landscape. If the EV/OCF ratio keeps falling toward historical lows, it could signal doubts about earnings momentum and cash generation. On the flip side, stabilizing near current levels might suggest the market is finding balance after recent volatility. The company's next earnings report will likely show whether Meta can regain its footing or face further multiple compression.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets