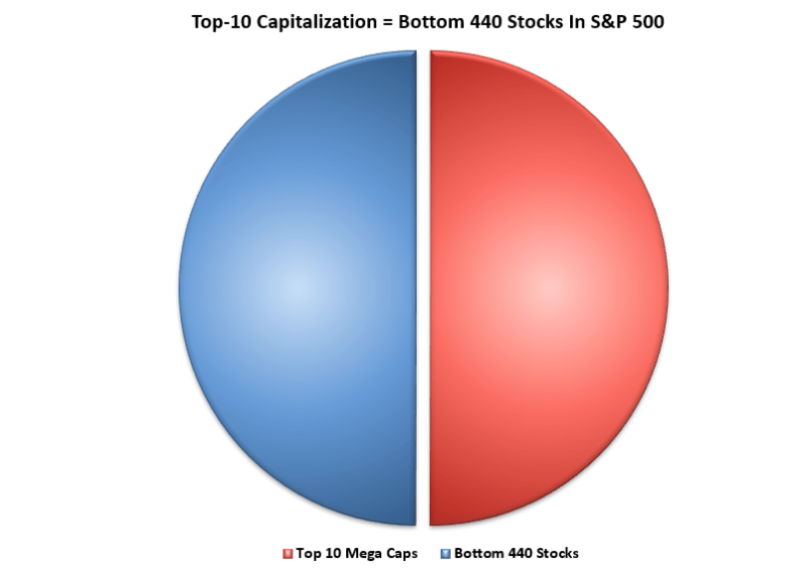

The U.S. stock market has reached extreme concentration levels. Recent analysis reveals that the ten largest companies in the S&P 500 now command a market capitalization matching that of the other 440 companies combined. This marks a significant shift in how the index operates and what diversification means for investors today.

A Market Split in Two

The data shared by Stock Sharks trader shows a perfect 50/50 divide: ten mega-cap stocks on one side, 440 companies on the other. This means just 2% of the index's constituents account for half its total value.

A decade ago, the top ten represented roughly 25% of the index. That figure has since doubled, driven largely by massive growth in firms like Apple, Microsoft, Nvidia, Amazon, Alphabet, and Meta. These companies haven't just lifted the index—they've fundamentally altered what diversification means within the S&P 500.

What This Means for Investors

While this concentration has delivered strong returns—fueled by AI expansion and cloud infrastructure growth—it also introduces new risks. Investors holding index funds are now more dependent than ever on a small group of tech giants. The S&P 500's traditional appeal as a diversified investment is diminishing. With half the index concentrated in ten firms, market swings and sector exposure increasingly hinge on the technology sector's performance.

Forces Behind the Shift

Several dynamics have driven this imbalance. The AI and data center boom has made Nvidia and its peers central to global equity growth. Meanwhile, passive investing has created a feedback loop: as more capital flows into S&P 500 ETFs, the largest companies automatically attract greater inflows, reinforcing their dominance.

Mega-caps also benefit from margin advantages and earnings resilience during periods of higher rates and inflation. These factors have transformed the S&P 500 into a tech-heavy growth vehicle, with industrials, energy, and financials contributing far less to overall returns.

Key Drivers Include:

AI and infrastructure expansion powering companies like Nvidia, passive fund inflows amplifying the largest holdings, and the operational advantages that mega-caps maintain in challenging economic conditions.

Usman Salis

Usman Salis

Usman Salis

Usman Salis