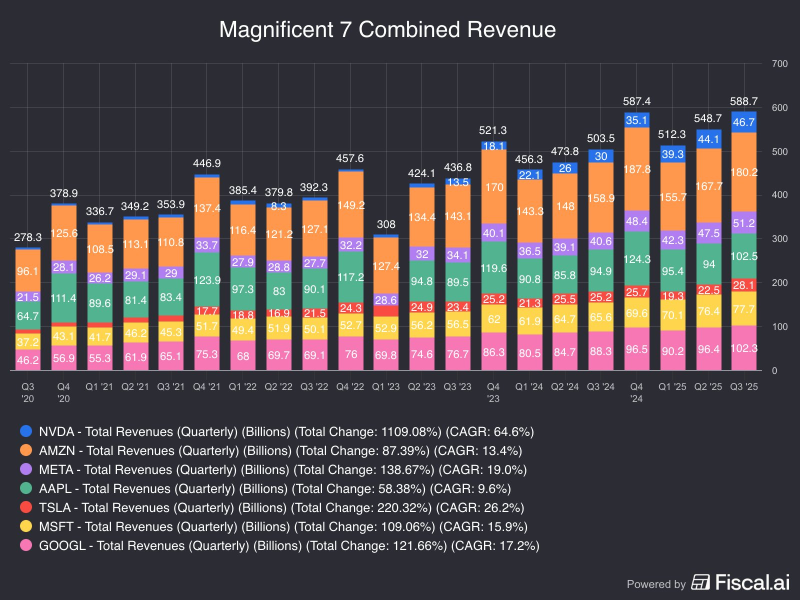

⬤ Fresh numbers from Fiscal.ai show the Magnificent 7 pulled in $588.7 billion together during Q3 2025, way up from $278.3 billion back in Q3 2020. That's a massive jump over five years, driven mainly by booming demand for AI infrastructure, cloud services, and consumer tech across the board. Nvidia, Apple, Amazon, Tesla, Microsoft, Meta, and Alphabet all played their part in pushing those numbers higher.

⬤ Nvidia saw the biggest leap among the group, hitting $46.7 billion in Q3 2025 after barely scraping single-digit billions five years ago. Tesla kept its momentum going strong with $31.5 billion for the quarter, powered by rising EV production and ongoing AI projects. Amazon brought in $180.2 billion thanks to solid growth in AWS and retail, while Meta reported $51.2 billion, Apple $102.5 billion, Microsoft $94.4 billion, and Alphabet $77.7 billion.

This marks a significant expansion over five years, reflecting rapid scaling across AI infrastructure, cloud computing and global consumer technology markets.

⬤ Looking at the trend from 2020 to 2025, revenue climbed steadily quarter after quarter, with big spikes lining up with major AI hardware releases and growing cloud adoption. Even when the broader economy hit rough patches, these companies kept growing, showing just how central AI and digital platforms have become to their business models.

⬤ What makes this particularly important is that the Magnificent 7 now make up a huge chunk of total S&P 500 revenue and basically steer where the entire market goes. Their nonstop expansion in AI, cloud tech, and platform services keeps shaping investor sentiment and sector trends heading into 2026.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah