⬤ IREN has released new guidance showing the company expects to hit $3.4 billion in annual recurring revenue by the end of 2026. This projection represents a 578.6% year-over-year increase, highlighting just how aggressively management expects the business to scale over the next two years. The outlook comes as IREN continues pushing through a period of rapid top-line growth.

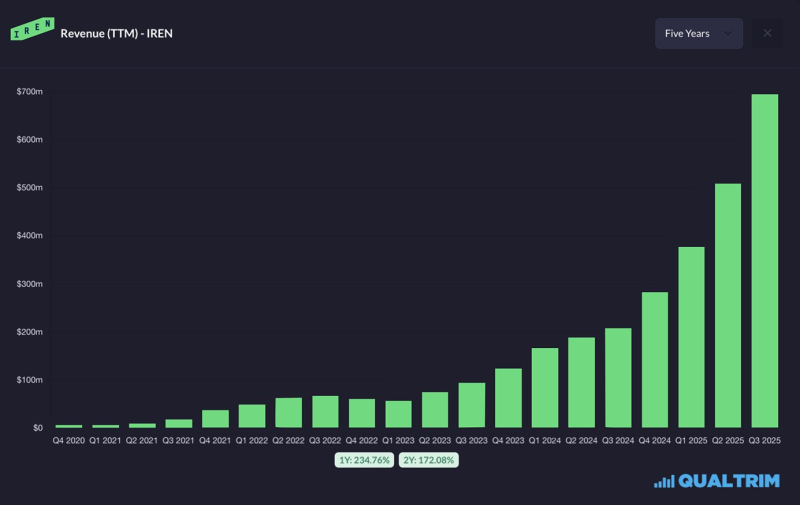

⬤ Recent performance data shows IREN's revenue trajectory has been climbing steadily. The company posted modest numbers through 2021, picked up steam in 2022, then hit a sharp acceleration starting in 2023. That momentum has carried through 2024 and into 2025, with trailing-twelve-month revenue now crossing $600 million. Year-over-year growth sits above 234%, while two-year growth tops 172%, showing the pace at which IREN's revenue base has been expanding ahead of this ambitious 2026 target.

⬤ ARR represents the recurring revenue IREN expects to pull in from customers on an annual basis, making the $3.4 billion figure a forward-looking snapshot of contracted or anticipated recurring income. While the guidance doesn't break out additional financial details, the number implies a significant leap from current levels. The visual trend confirms IREN has already been posting sustained quarterly increases, setting up the foundation for this aggressive outlook.

⬤ This guidance matters because it positions IREN as a serious high-growth player in the broader technology and digital infrastructure space. Actually hitting that $3.4 billion ARR mark would mean a multiple-fold expansion of the company's current revenue footprint and signal that demand momentum is staying strong. Market watchers will be tracking how closely IREN sticks to this target through its upcoming quarterly reports, with the new guidance providing a clear benchmark for expected performance over the next two years.

Usman Salis

Usman Salis

Usman Salis

Usman Salis