Intel (INTC), once considered the backbone of the global semiconductor industry, is now navigating one of the most challenging periods in its corporate history. After maintaining consistent operating profitability for decades, the company's EBIT has slipped into negative territory - a dramatic shift that illustrates how quickly dominance can fade in the technology sector. This analysis examines Intel's long-term performance and explores what lies ahead for the struggling chipmaker.

Intel's Historic Profit Trend Ends Abruptly

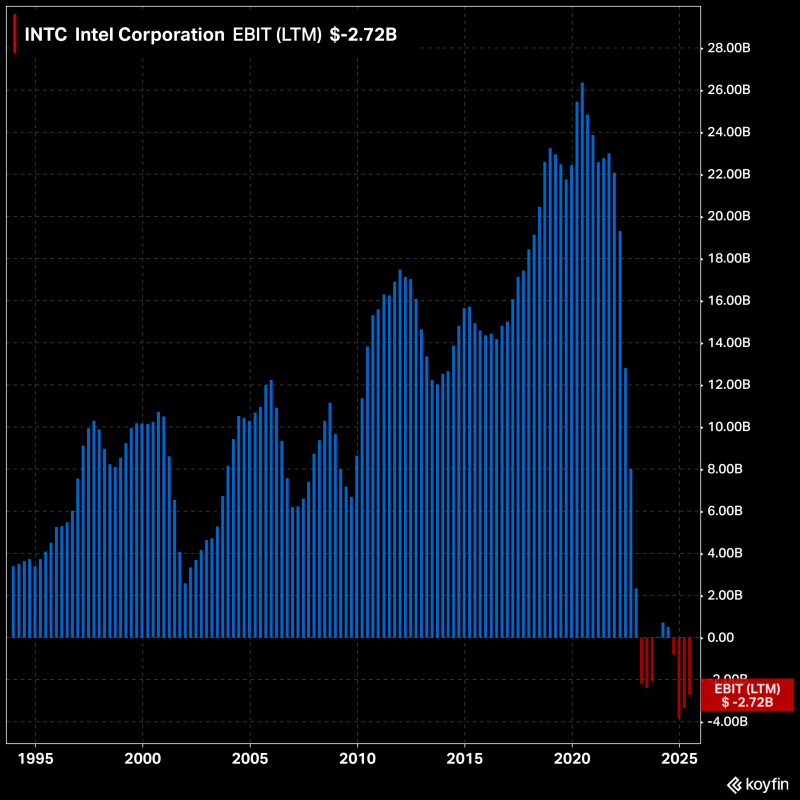

A chart from Koyfin trader shows Intel's operating profit trajectory spanning nearly three decades. From the mid-1990s through 2021, EBIT climbed steadily despite occasional cyclical downturns, eventually reaching a peak above $26 billion around 2020.

That extended growth came to an abrupt halt in 2023. Since then, Intel's profitability has deteriorated rapidly, and as of 2025, the company reports negative EBIT of -$2.72 billion. This represents the first sustained period of operating losses in modern Intel history, underscoring just how severe the current challenges have become.

What the Data Reveals

The numbers tell a stark story. Between 1995 and 2020, Intel consistently expanded its operating profits, with notable peaks during the dot-com boom and PC growth cycles of the 2010s. EBIT exceeded $26 billion in 2020, marking Intel's best result on record. But after 2021, profits fell sharply, weighed down by shrinking margins, weakening demand, and fiercer competition. By 2025, EBIT had turned negative at -$2.72 billion, replacing decades of blue profit bars with red losses. This reversal confirms that Intel's era of reliable profitability ended abruptly after 2023.

Why Intel's Profits Collapsed

Several structural and market pressures explain the downturn. Rising competition from AMD and NVIDIA has eroded Intel's dominance across CPUs, GPUs, and AI processors. Manufacturing delays in developing advanced chip nodes have weakened the company's technological edge. The global PC market also declined sharply following the pandemic-era peak, hitting Intel's core revenue hard. Meanwhile, heavy capital spending on foundry projects and new fabrication plants has strained operating margins even further.

What Could Drive a Turnaround

Intel's path to recovery depends on execution across multiple fronts. The company's foundry business needs to successfully compete with TSMC and Samsung to diversify earnings. Gaining meaningful share in the rapidly growing AI hardware market is essential for future growth. Delivering on promised technology roadmaps will be critical to rebuilding credibility with investors and customers alike. And any recovery in PC and server demand would provide much-needed support to stabilize revenues.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah