⬤ Google stock hit a new record while the wider tech market dropped. Its third quarter numbers showed fatter profit margins and rising demand in every main unit. The share price rose even as the Nasdaq 100 slid almost 3 percent. Search drew more queries, YouTube kept growing besides Cloud earned more money. Revenue for Q3 2025 reached $102.3 billion, 15.9 percent above the year ago figure.

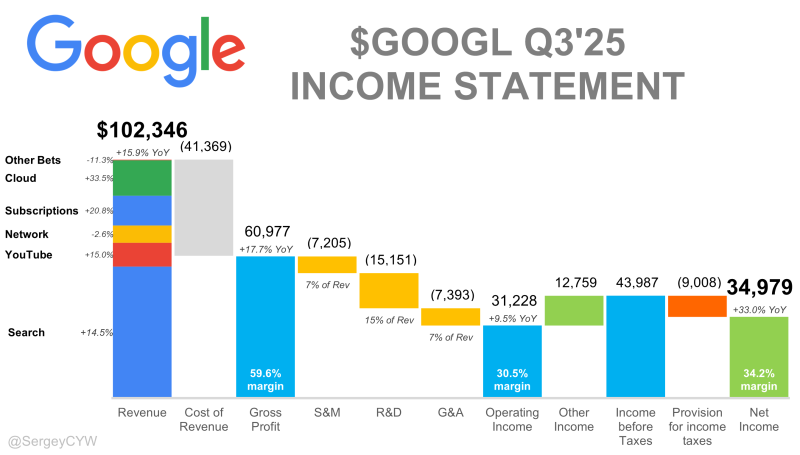

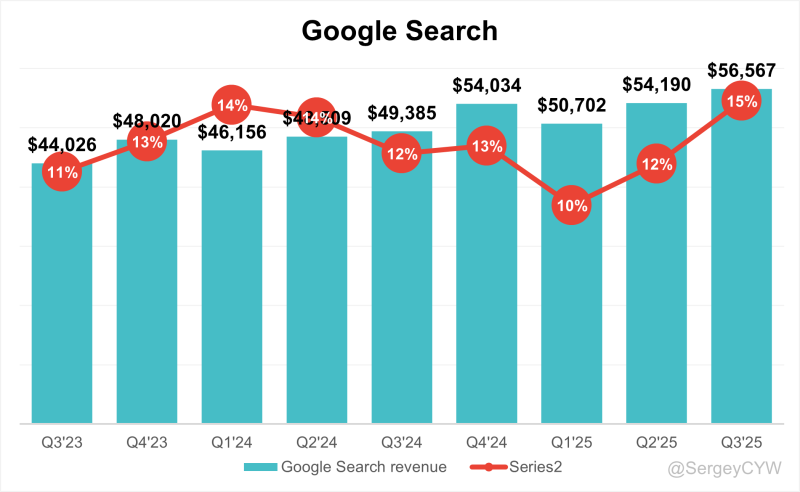

⬤ Search remained the largest earner bringing in $56.6 billion. YouTube ads passed $10 billion for the quarter confirming its place among the world's top ad venues. Subscriptions added $12.9 billion giving the firm a stable repeating income stream. Google Cloud booked $15.2 billion and moved further into the black converting past spending into a genuine profit source. Gross profit totaled $61 billion, equal to a 59.6 percent margin plus operating income grew 9.5 percent year over year to $31.2 billion.

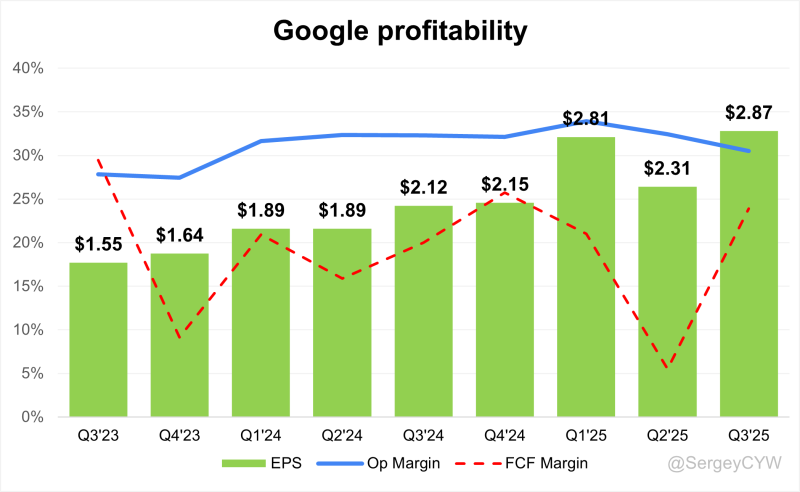

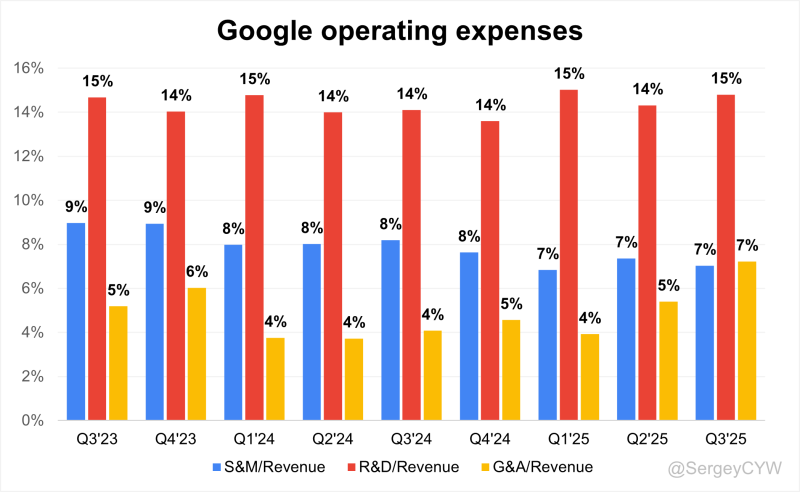

⬤ Every key profit gauge improved. Net income hit $35 billion, a 34.2 percent margin. Free cash flow margin reached 23.9 percent or Cloud margin advanced to 23.7 percent. Earnings per share for Q3 2025 rose to $2.87, lifted by higher revenue and tighter cost control.

⬤ Faster AI uptake added thrust to Google's progress. Enterprise sign ups for Gemini keep rising next to Waymo nears a broader commercial launch. The firm disclosed a $155 billion Cloud backlog signaling solid long term demand. Spending on AI servers and related depreciation keeps climbing - yet the order book implies that those outlays will drive the next growth leg. Wider markets slipped, but deeper profits but also widening prospects keep Google moving ahead.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova