⬤ Dell Technologies is catching eyes after a fundamentals review that puts business quality ahead of short-term price action. The analysis takes cues from Warren Buffett's playbook of holding solid businesses that grow steadily rather than chasing chart patterns. The weekly chart and valuation data frame Dell as a case study in this approach, spotlighting operational strength and balanced pricing over pure momentum.

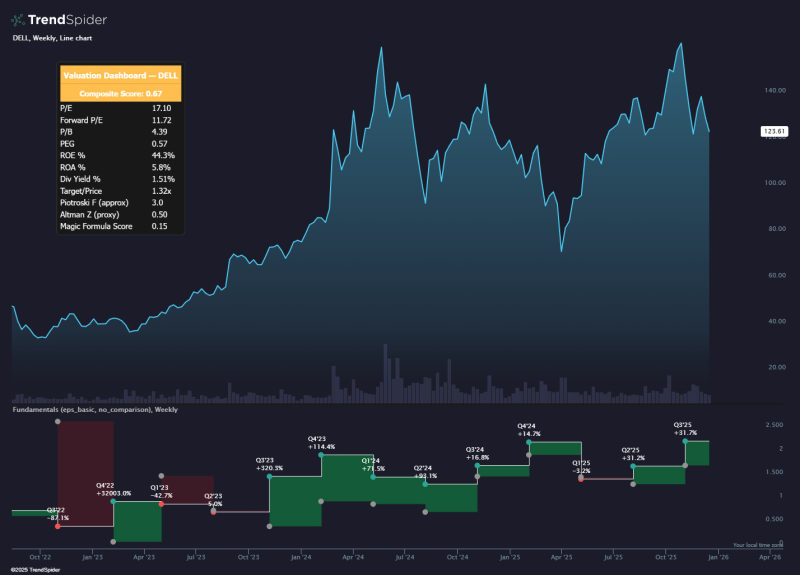

⬤ The valuation breakdown reveals Dell's financial position across several key measures. The stock sits at a price-to-earnings ratio around 17.1, while the forward P/E drops to roughly 11.7, pointing to softer expectations ahead. Return on equity tops 44 percent with positive asset returns, showing Dell's ability to generate profits efficiently. A PEG ratio under 1 and a composite valuation score of 0.67 round out the picture, blending earnings strength, operational efficiency, and disciplined pricing that fits the long-term compounding story.

The framework draws inspiration from Warren Buffett's approach of owning durable businesses that compound over time rather than trading charts.

⬤ The weekly chart shows Dell's path over time, with sharp climbs followed by pullbacks instead of a steady upward line. After a strong run earlier in the cycle, the stock hit volatility before finding its footing, recently hovering near $120. Volume picked up during major moves, suggesting active participation through both rallies and corrections. The earnings timeline below displays a mix of high-growth quarters and occasional slowdowns, making it clear Dell's compounding happens across cycles, not in one smooth stretch.

⬤ This matters for the broader market because Dell represents the technology sector's enterprise infrastructure side—real operations and cash generation. Companies with high ROE, reasonable multiples, and steady cash flow often draw attention when markets shift toward fundamentals instead of speculative plays. As Dell trades within its established range, the combination of these valuation metrics and price patterns could influence how investors view established tech names that prioritize durability and long-term growth in today's shifting landscape.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova