Arm Holdings saw an explosive trading session today, with shares jumping over 11% and drawing intense attention from options traders. The action centered on $230 strike calls expiring October 24—contracts sitting nearly $60 out of the money. Despite the aggressive pricing, demand remained strong, signaling bullish conviction around the stock's near-term trajectory.

What's Driving the Action

Several catalysts are fueling trader interest in Arm:

- AI chip demand: Arm's chip designs play a central role in the AI hardware ecosystem, riding the same wave benefiting companies like Nvidia and AMD

- Post-IPO momentum: The stock continues attracting volatility-seeking traders following its high-profile public debut

- Broader tech sentiment: Enthusiasm around semiconductors and artificial intelligence is pushing investors toward growth-oriented names

The Options Play

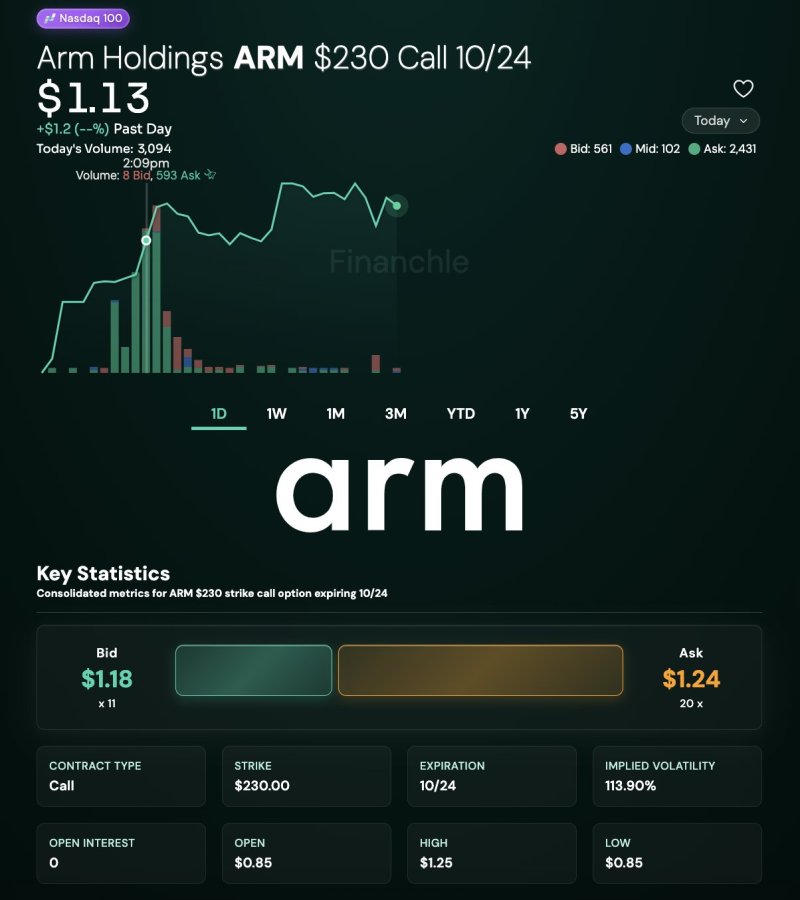

Trader Financhle highlighted the buying frenzy, noting that the $230 calls traded around $1.13 with elevated ask-side demand. Implied volatility spiked near 114%, reflecting expectations of significant price movement ahead. While these contracts are deeply out of the money, the willingness to pay premium prices suggests some traders believe a sharp continuation rally is possible.

The chart backs up the bullish case. Arm's intraday price action showed consistent strength, with volume surging alongside the rally. Higher highs and higher lows throughout the session pointed to sustained buying pressure, though whether this momentum can carry the stock another $60 higher in under two weeks remains highly uncertain.

Risk and Reality

These bets carry substantial risk. With expiration approaching quickly, time decay works against the position unless Arm maintains extreme upward momentum. Most of these contracts will likely expire worthless. Still, in today's liquidity-rich, AI-driven market, sudden rallies can materialize faster than fundamentals would suggest.

For now, Arm has positioned itself not just as a semiconductor player, but as a high-octane trading vehicle for risk-tolerant speculators hunting outsized returns.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova