Apple's financial data reveals a puzzling contradiction. Over nearly six years, the company's revenue has barely budged, yet its stock price has multiplied more than fourfold. This disconnect between business fundamentals and market valuation has caught the attention of market observers who question whether such dynamics reflect genuine value creation or something else entirely.

Revenue Stuck in Neutral

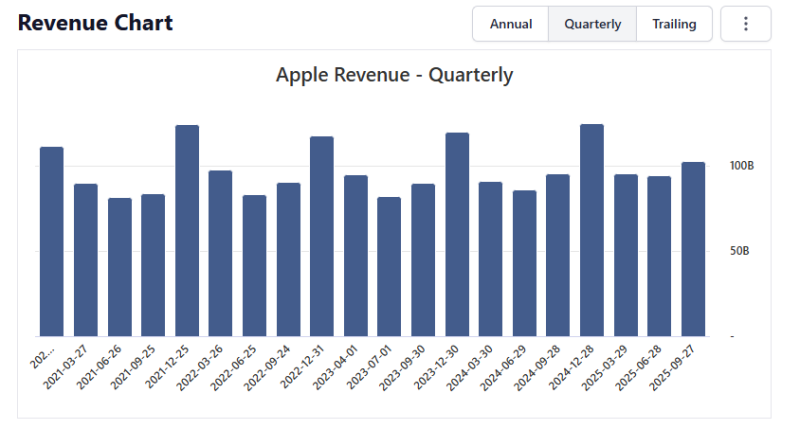

Apple's quarterly revenue chart paints a clear picture: the company has been treading water since 2020. Revenue fluctuates between $85 billion and $100 billion per quarter, with no meaningful upward trajectory. A recent observation by trader blake highlighted this stagnation, noting that the pattern "looks more like a ponzi scheme than a free market."

The numbers tell the story. Revenue peaked in 2021 following the iPhone 12 launch and pandemic-driven electronics demand. From 2022 through 2023, figures steadied around $90 billion with predictable seasonal swings. Fast forward to 2024 and 2025, and despite new product launches and expanded services, quarterly results still hover around $95-100 billion. Apple maintains strong performance, but it's essentially flatlined at a mature baseline.

Why the Stock Keeps Climbing

If revenue isn't growing, what's pushing the stock higher? Several forces are at work. Apple has been buying back shares aggressively, reducing the number of outstanding shares and artificially inflating earnings per share. Investors also treat Apple as a safe harbor during uncertain times, drawn to its massive cash reserves, reliable profit margins, and iconic brand strength. Years of low interest rates and central bank liquidity injections have funneled capital into mega-cap tech stocks, lifting valuations across the sector. Add to that the speculative premium around AI integration into Apple's ecosystem, and you have a stock that rises on faith rather than fundamentals.

What the Chart Really Shows

The revenue chart confirms what the numbers suggest: there's no growth story here, just consistency. Each year follows the same rhythm with a holiday quarter spike in Q4 and a subsequent dip, but the ceiling and floor remain remarkably stable. This reflects both Apple's operational excellence and its growth constraints. The company dominates mature markets like smartphones and tablets but faces saturation. While wearables and services contribute profits, they haven't been transformative enough to move the revenue needle significantly. Meanwhile, the company's market cap keeps climbing, creating a widening gap between business reality and investor valuation.

A Liquidity-Driven Market

Apple isn't alone in this phenomenon. Across mega-cap tech, valuation multiples have expanded dramatically while revenue growth has cooled. Investors increasingly bet on central bank policies, share buybacks, and brand dominance rather than organic earnings expansion. Apple's steady revenue gets interpreted as safety in an unpredictable world, but this perception carries risk. If interest rates remain elevated or global demand weakens, the premium investors pay for Apple's stability could evaporate quickly.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah