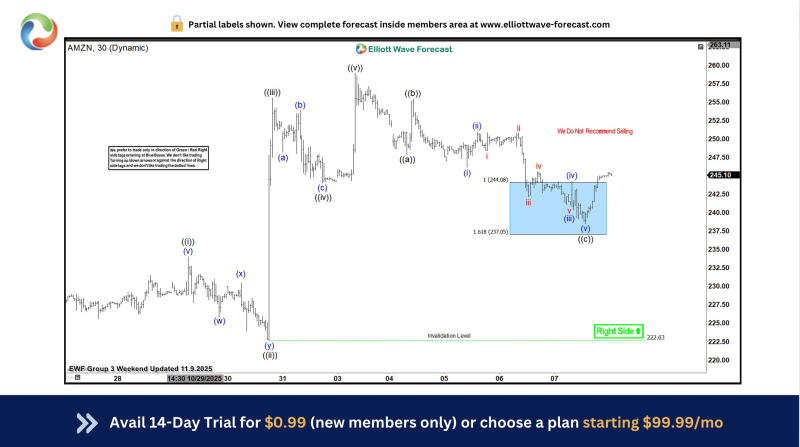

⬤ Amazon's stock has fallen into an anticipated support area between $237 and $244—a zone that typically triggers strong rebounds based on Elliott Wave patterns. The chart shows a completed corrective structure with price now sitting in the blue "extreme area." As long as Friday's low stays intact, the technical setup suggests AMZN should start rallying toward new highs, or at a minimum deliver a solid three-wave bounce upward.

⬤ New tax proposals add uncertainty for Amazon right now. Potential changes to corporate tax rates, digital taxation, and R&D deductions could squeeze Amazon's suppliers and smaller partners, raising bankruptcy risks across its ecosystem. This regulatory uncertainty comes at a tricky time when the stock's performance depends heavily on operational efficiency and earnings growth.

⬤ The technical picture looks bullish. Price completed a five-wave drop into the extreme zone near $237, bounced off that level, and started forming upward moves. The chart annotation signals downside exhaustion and favors trading in the direction of an expected continued rally.

⬤ With AMZN stabilizing inside this high-probability reversal zone, investors are watching closely for signs of a sustained recovery. If Friday's low continues to hold, the technical roadmap points toward a potentially strong rally to new highs.

Peter Smith

Peter Smith

Peter Smith

Peter Smith