Amazon (AMZN) shares fell significantly following a disappointing third-quarter sales outlook, raising concerns on Wall Street.

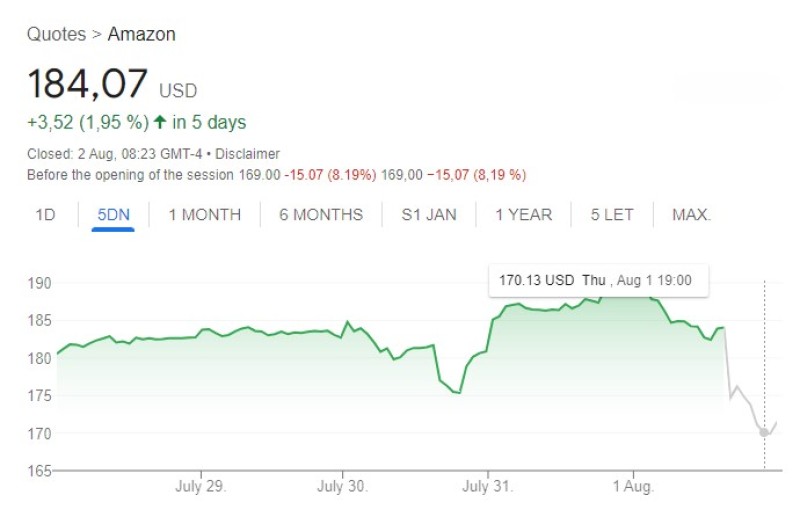

Amazon (AMZN) experienced a substantial drop in its stock price, falling over 8% in pre-market trading on Friday. This downturn came after the company reported its third-quarter sales guidance, which failed to meet analyst expectations. According to Bloomberg data, Amazon projected sales between $154 billion and $158.5 billion, whereas analysts had anticipated around $158.43 billion.

Despite Amazon posting earnings per share (EPS) of $1.26, surpassing the estimated $1.04 and nearly doubling profits from the same period last year, investors remained concerned. The company's revenue totaled $148 billion, slightly below the expected $148.8 billion, which added to the negative sentiment. Even Amazon's thriving advertising segment, which has consistently shown double-digit growth, fell short of expectations with $12.8 billion in revenue against the predicted $13 billion.

AWS Outshines Expectations

A highlight of Amazon's report was its cloud business, Amazon Web Services (AWS). AWS brought in $26.3 billion in revenue, exceeding the expected $26 billion and significantly above the $22.1 billion reported during the same quarter last year. Amazon's CFO, Brian Olsavsky, announced that AWS is on track to generate over $105 billion annually, reflecting the robust demand for its services.

Amazon, like many of its peers, is heavily investing in infrastructure to support the rapid deployment of new AI technologies and cloud services. Olsavsky disclosed that the company has spent over $30 billion in the first half of the year on capital expenditures, primarily to meet the growing demand for AWS services and generative AI tools. These investments are expected to increase in the latter half of the year.

Big Tech Performance and Market Reactions

Amazon's report followed mixed results from other tech giants. Earlier, Microsoft's (MSFT) cloud revenue miss led to a decline in its shares, despite beating overall expectations. Similarly, Alphabet (GOOG, GOOGL) reported lower-than-expected YouTube ad revenue, causing investor concern. On a positive note, Meta (META) received a favorable response from Wall Street after delivering better-than-expected revenue and profit, with shares climbing more than 4% on Thursday. Meanwhile, Apple (AAPL) reported solid earnings, beating expectations despite a year-over-year dip in iPhone sales.

Overall, Amazon's disappointing sales forecast has heightened scrutiny on its core business and emphasized the challenges Big Tech companies face in balancing growth with massive investments in AI and infrastructure.

Usman Salis

Usman Salis

Usman Salis

Usman Salis