Amazon has always been the poster child for expensive growth stocks - the kind of company value investors avoided like the plague. But something's changed. The Harris Oakmark U.S. Large Value Strategy just named Amazon one of their top picks, arguing that recent stock weakness has created a genuine value opportunity in what might be the most dominant business empire of our time.

Why Smart Money Is Backing Amazon Now

According to insights shared by Stock Analysis Compilation, the fund's logic is pretty straightforward, and it makes sense when you break it down. Amazon isn't just an online retailer anymore - it's basically the infrastructure of modern commerce. They've got the biggest slice of U.S. online shopping, and that Prime membership flywheel keeps spinning faster. Meanwhile, AWS still dominates cloud computing while every company on earth rushes to digitize everything.

Here's what really caught Oakmark's attention: Amazon trades below what they think it's actually worth based on long-term earnings power. After months of getting beaten up by worried investors, the stock price doesn't reflect the company's true strength. The integrated ecosystem spanning retail, ads, logistics, and cloud computing creates what investors call a "moat" - basically, it's really hard for competitors to challenge Amazon's position.

The Reality Behind the Opportunity

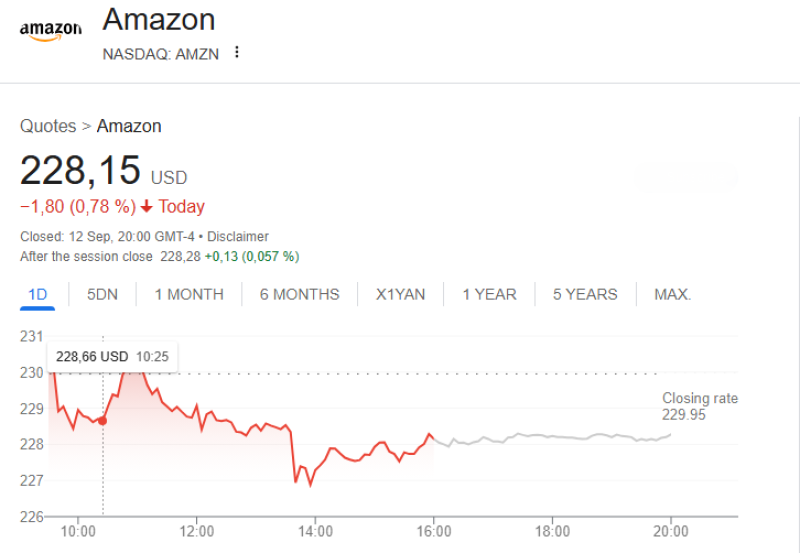

Amazon's stock has been taking hits lately, and for understandable reasons. Consumers are tightening their belts, cloud competition is heating up, and the broader market has been all over the place. But the big trends that made Amazon successful haven't disappeared. Companies still need cloud services, people still want fast delivery, and AI is creating massive demand for the kind of infrastructure Amazon provides.

What's interesting is seeing a tech giant that was once purely a growth story now attracting value-focused investors. It suggests the market might be overreacting to short-term challenges while missing the bigger picture.

The path forward depends on a few key things: whether AWS can keep growing, how efficiently Amazon can run its retail operations, and how well they execute in high-margin areas like advertising and AI services. For investors willing to wait it out, Oakmark's bet is that today's discounted price won't last forever. Sometimes the best opportunities come disguised as temporary problems.

Usman Salis

Usman Salis

Usman Salis

Usman Salis