Not long ago, AMD was written off as just another struggling chipmaker fighting for scraps in a market dominated by giants. Fast forward to today, and the company has become a genuine force in the AI revolution that's reshaping the tech landscape. Revenue numbers are hitting record highs, projections look increasingly ambitious, and the story of AMD's resurrection under CEO Lisa Su reads like one of the most impressive comeback tales in Silicon Valley history.

From the Brink to Breakthrough: The Lisa Su Era

A recent observation by @meeijer captured the essence of this turnaround perfectly, noting how Su has orchestrated not just a recovery but a complete repositioning of AMD as a serious contender in the explosive AI accelerator market.

When Lisa Su stepped into the CEO role back in 2012, AMD was in rough shape. The company was bleeding money, revenues were sliding, and investor confidence had pretty much evaporated. What followed was nothing short of a masterclass in corporate transformation. Su didn't just patch things up—she fundamentally rebuilt AMD from the ground up, returning the company to profitability, launching competitive product lines that could actually go toe-to-toe with Intel and Nvidia, and delivering shareholder returns north of 2,000%. Not bad for a company many had written off.

Now Su has her sights set on something even bigger: the AI accelerator market. Analysts expect this sector to grow at a blistering 60% compound annual growth rate, potentially ballooning to $500 billion in the years ahead. Here's where things get interesting for AMD investors. If the company manages to capture just 10% of that market—a reasonable goal given their technology and partnerships—we're looking at revenues pushing toward $50 billion. Run those numbers through typical valuation multiples, and you land somewhere around a $500 billion market cap, roughly double where AMD trades today.

What the Revenue Numbers Tell Us

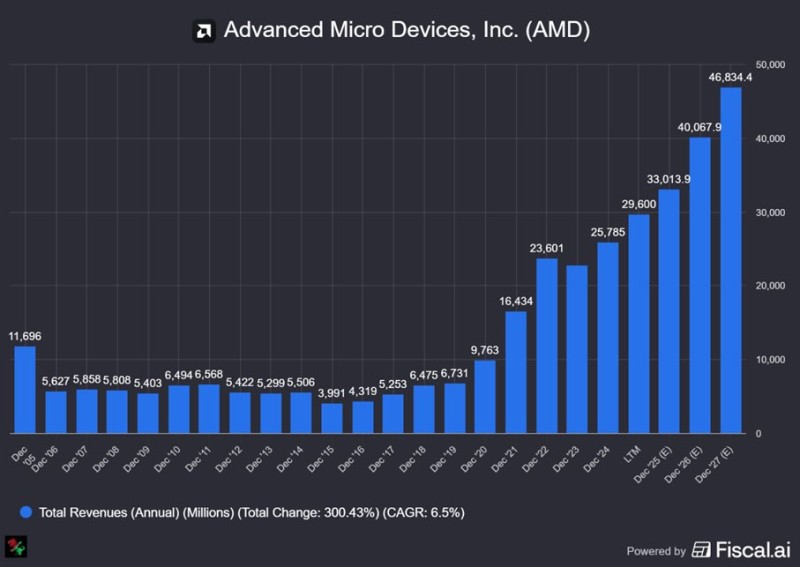

The revenue trajectory tells the story better than any press release could. From 2006 through 2016, AMD was essentially treading water, with annual revenues bouncing around between $3 billion and $6 billion. It was a lost decade. Then something changed. Between 2017 and 2021, revenues broke out, climbing steadily to hit $16.4 billion. The momentum only accelerated from there, with 2022 and 2023 bringing in $23.6 billion and $29.6 billion respectively. Current estimates for 2024 put revenues around $40 billion, with projections approaching $47 billion by 2027.

This isn't just growth—it's sustained, accelerating expansion driven by AMD's increasing footprint across CPUs, GPUs, and particularly in data center solutions that are riding the AI wave.

Peter Smith

Peter Smith

Peter Smith

Peter Smith