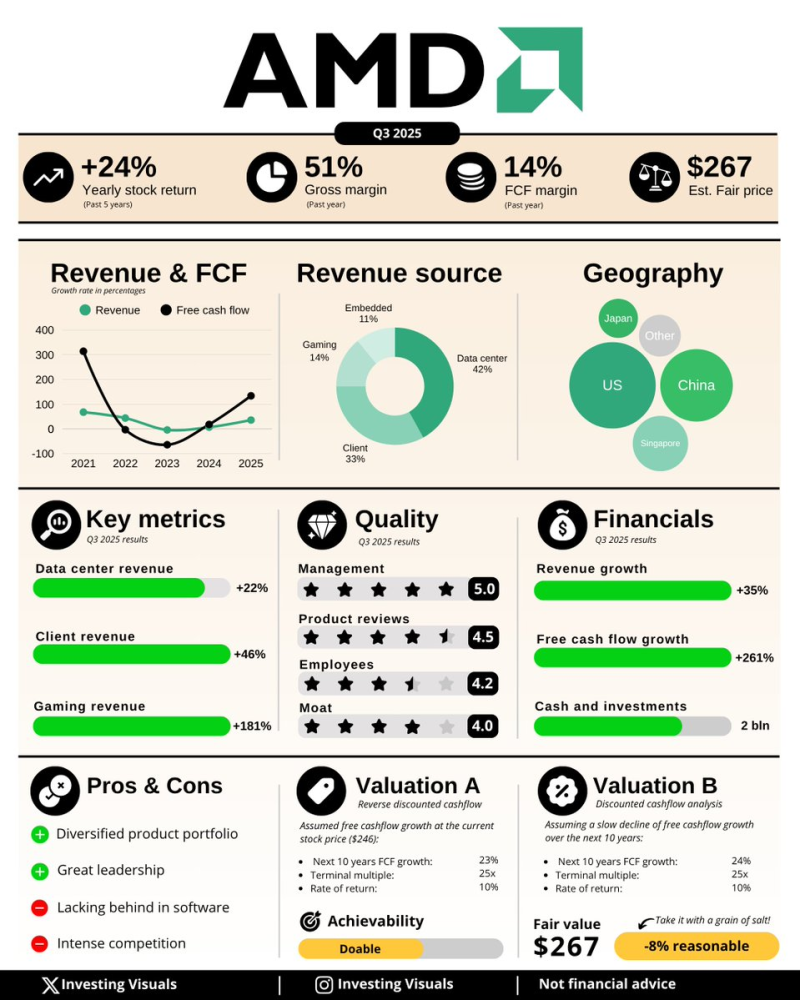

⬤ AMD delivered strong Q3 2025 performance with shares climbing 106 percent year-to-date while maintaining reasonable valuation levels. The company achieved a 51 percent gross margin and 14 percent free-cash-flow margin over the past year. Revenue remains well-diversified with data centers contributing 42 percent, client products 33 percent, gaming 14 percent, and embedded solutions 11 percent of total sales.

⬤ Segment performance demonstrates the power of AMD's current product lineup. Data center revenue jumped 22 percent year-over-year on surging demand for accelerated computing. Client revenue climbed 46 percent as PC markets improved, while gaming revenue skyrocketed 181 percent from the prior year. Overall revenue expanded 35 percent and free cash flow surged over 260 percent. The company holds approximately 2 billion dollars in cash and investments, with fair-value estimates reaching 267 dollars per share.

⬤ AMD earned top operational scores including 5.0 for management quality and 4.5 for product reviews. The company faces ongoing competitive pressure and relative software weakness, yet continues advancing its market position in AI-focused data center workloads and client computing through consistent demand across major product categories.

⬤ The latest results matter because strengthening revenue trends and expanding cash flow highlight AMD's growing role in high-performance computing and AI infrastructure. Company execution over the next few years will shape competitive dynamics across the semiconductor industry and set expectations for future product cycles.

Usman Salis

Usman Salis

Usman Salis

Usman Salis