After surging 70% in just two months, AMD looks poised for a breather. The options market is flashing clear signals that professional traders are shifting toward more conservative positioning, betting on reduced volatility and capped upside. This shift suggests that AMD's recent momentum may be cooling as the stock enters a period of consolidation ahead of its earnings report.

Strats Labs: Call Ratio Spread for Controlled Exposure

Strats Labs recently highlighted a strategic trade: selling a November 7 Call Ratio Spread for $158 credit per contract. The structure is designed to profit if AMD stays within roughly ±7% of current levels, offering a 91% probability of success.

This type of setup favors time decay and stable pricing rather than chasing further directional moves. It's the kind of trade that typically emerges near the end of strong rallies when traders would rather collect premium than bet on additional gains.

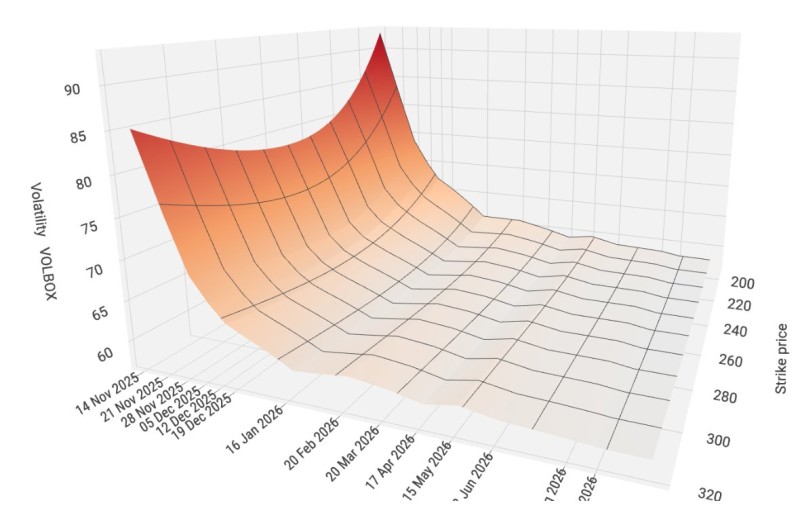

Chart Analysis: Volatility Curve Flattening Through 2026

The VOLBOX chart provides insight into how volatility expectations are evolving across different strike prices and timeframes. Near-term volatility peaks sharply in November and December 2025, then gradually declines into mid-2026, creating a smooth downward slope. This pattern indicates that traders anticipate short-term turbulence, likely tied to upcoming catalysts like earnings or AI chip announcements, followed by a return to calmer conditions. The flattening curve also reflects weaker demand for out-of-the-money options, suggesting growing confidence that AMD will trade within a range rather than making dramatic moves.

Broader Context: After the Rally, a Pause for Breath

AMD's rally was driven by strong investor optimism around AI infrastructure and data center demand, pushing implied volatility to multi-month highs. Now traders appear to be recalibrating their outlook, taking profits and preparing for a slower growth phase. As the chart shows, volatility premium is compressing across the board, a sign that option buyers are stepping back while sellers take control of near-term sentiment.

Stability Before the Next Move

If implied volatility continues flattening as the chart suggests, AMD could trade sideways in the near term, creating opportunities for premium sellers and ratio spread strategies. That said, any unexpected earnings surprise or macro shock could quickly reignite volatility, especially on the near end of the curve. For now, the market's message is clear: after a historic rally, AMD's next chapter may be defined less by momentum and more by equilibrium.

Peter Smith

Peter Smith

Peter Smith

Peter Smith