- Gold Doesn’t Need a Wi-Fi Signal

- Tangible Wealth Is Emotional Wealth

- The Rise of Hybrid Investors

- Where Trust Meets Tangibility: Why Muzeum Matters

- Artifacts Are the New Assets

- Why Younger Generations Are Turning to Old-World Value

- How Precious Metals Fit the Future of Wealth

- Final Thought: In a Noisy World, Solidity Speaks Louder

Gold Doesn’t Need a Wi-Fi Signal

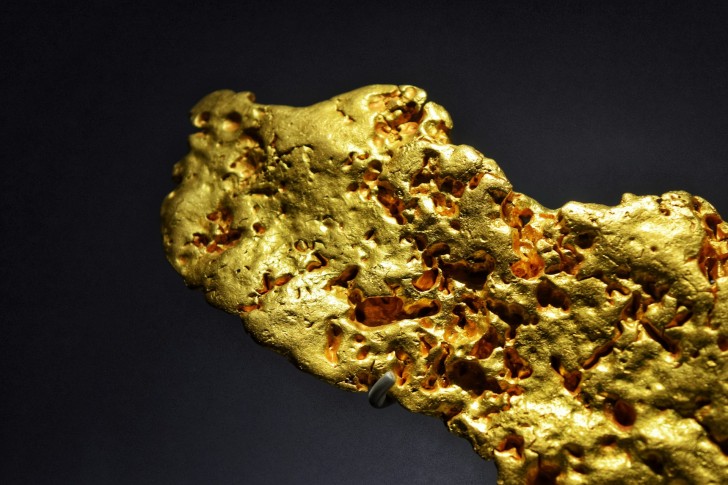

While cryptocurrency markets shake under regulatory pressure and tech stocks flutter with every earnings report, gold continues doing what it has always done: holding value. It doesn’t trend. It doesn’t tweet. But when inflation creeps up or currencies falter, people still reach for it. That’s not sentimentality — that’s strategy.

Precious metals like gold and silver offer something increasingly rare in today’s economy: stability. They’re not correlated with equity markets, they’re immune to data breaches, and no one can just “print” more of them on a whim. In times of economic uncertainty, their appeal sharpens.

Tangible Wealth Is Emotional Wealth

There’s something primal about holding wealth in your hands. Digital assets are convenient, sure, but they’re also abstract. You can’t display an NFT on your mantle. You can’t pass a stock certificate down through generations in a velvet box. But a coin struck in the early 1900s? Or a slabbed bar of gold? That’s generational.

And here’s the key: it’s not just investors who care. Collectors, artists, and cultural tastemakers are all looking for rare, one-of-a-kind objects that bridge history and modernity. This is where tangible wealth becomes a form of storytelling, and that story gains value the longer it lives.

The Rise of Hybrid Investors

Today’s smart investors don’t limit themselves to one world. They operate in both. Yes, they hold a diversified portfolio. Yes, they might dabble in crypto or real estate. But they’re also investing in hard assets that aren’t bound to a stock ticker.

Institutions are catching on. Pension funds and family offices are increasing allocations to precious metals. Even sovereign nations are stockpiling gold at record levels. Why? Because fiat currencies are fragile, geopolitical risks are growing, and digitized markets move fast, sometimes too fast. Tangible assets provide ballast.

Where Trust Meets Tangibility: Why Muzeum Matters

It’s one thing to decide to buy gold or rare coins. It’s another to know where to get them. Reputation matters, and in Canada, few names carry the same weight as Muzeum. With a carefully curated collection of gold, silver, coins, banknotes, and historical artifacts, Muzeum isn’t just a dealer. It’s a trusted gateway into the world of tangible assets.

They don’t operate like a faceless online marketplace. They blend education with curation, helping buyers understand what they’re acquiring and why it matters. Whether you’re a seasoned investor or a first-time collector, this kind of guidance makes a difference. Especially in an era where misinformation spreads faster than gold prices rise.

Artifacts Are the New Assets

Tangible value isn’t just about precious metals. It’s about provenance, scarcity, and meaning. Think rare banknotes from a turning point in history. Military medals with stories etched in every scratch. Limited-mintage collectibles that will never be produced again.

This isn’t nostalgia — it’s intelligent investing. In a marketplace where mass production and digital replication are the norm, scarcity is the ultimate flex. Collectibles and artifacts with historical or cultural significance are appreciating, not depreciating. And they’re not subject to algorithmic volatility or tech disruptions.

Why Younger Generations Are Turning to Old-World Value

There’s a misconception that only boomers buy gold. That couldn’t be further from the truth. Gen Z and millennials are increasingly looking at hard assets, especially as they grow skeptical of traditional institutions and the instability of purely digital finance.

Physical collectibles allow them to diversify while tapping into aesthetics, identity, and heritage. It’s not just an investment — it’s a statement. And platforms like Muzeum make that access feel modern, frictionless, and curated without losing the soul of the piece.

How Precious Metals Fit the Future of Wealth

Let’s be clear: this isn’t about going backward. It’s about layering your portfolio with smart, tangible assets that don’t expire with the next update. Gold and silver have historically performed well during market downturns, currency devaluations, and global crises. That kind of resilience is becoming more desirable, not less.

In fact, many financial advisors now recommend holding between 5% and 15% of your portfolio in precious metals. Not just as insurance, but as a smart, steady long-term move.

Final Thought: In a Noisy World, Solidity Speaks Louder

As digital noise accelerates, the appeal of tangible, trustworthy assets only grows. Whether it’s a gold coin, a silver bar, or a rare collectible with a story worth telling, these objects are more than investments. They’re anchors.

So while everyone else is chasing the next buzzword or blockchain trend, take a beat. Think about what actually lasts. Then consider where trust, history, and real value intersect.

Because in this digitized economy, solidity isn’t just a luxury — it’s a power move.

Editorial staff

Editorial staff

Editorial staff

Editorial staff