Implied volatility for NVIDIA (NVDA) has taken a sharp dive, drawing attention from traders and analysts alike. With the 1-month 25-delta call implied volatility reaching one of its lowest levels in recent years, many are questioning whether this signals a prime opportunity to go long on volatility.

Volatility Near Historic Lows

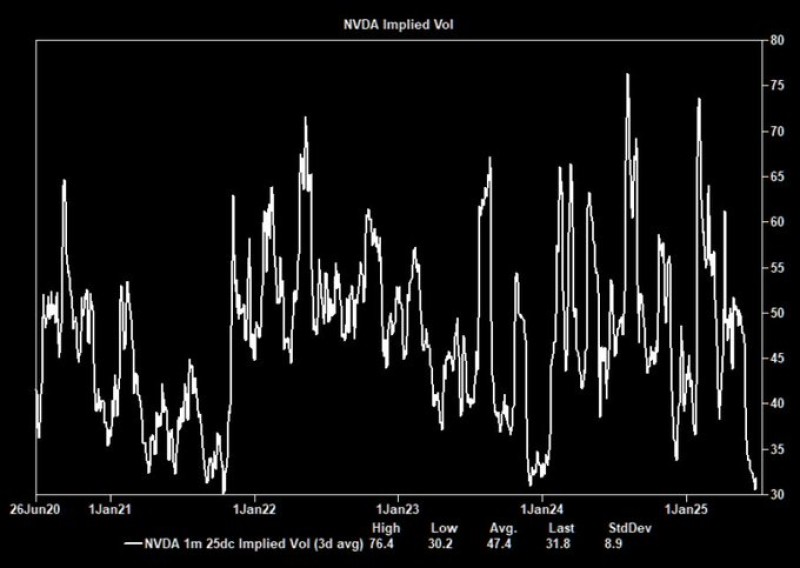

NVDA's 1-month 25-delta call implied volatility (3-day average) currently stands at 31.8, significantly below the historical average of 47.4. The recent drop places volatility near its multi-year low of 30.2, with the historical high marked at 76.4. The standard deviation is measured at 8.9, reinforcing how compressed the current volatility truly is.

Such a low reading suggests that the market is pricing in a period of calm — a potential setup for an unexpected move. Historically, volatility spikes tend to follow extended periods of compression like this.

Is Now the Time to Go Long Volatility?

While low implied volatility often signals reduced short-term risk, it can also precede sharp directional moves — up or down. Given NVIDIA’s prominence in AI and tech sectors, even a small shift in sentiment or earnings surprise could dramatically impact the stock. For those betting on movement rather than direction, long volatility positions might be worth exploring.

Conclusion

As NVDA volatility hovers near multi-year lows, options traders are watching closely for signs of a breakout. Whether you see this as a calm before the storm or just a quiet phase, the current setup could present opportunities for those ready to trade the next big move.

Peter Smith

Peter Smith

Peter Smith

Peter Smith