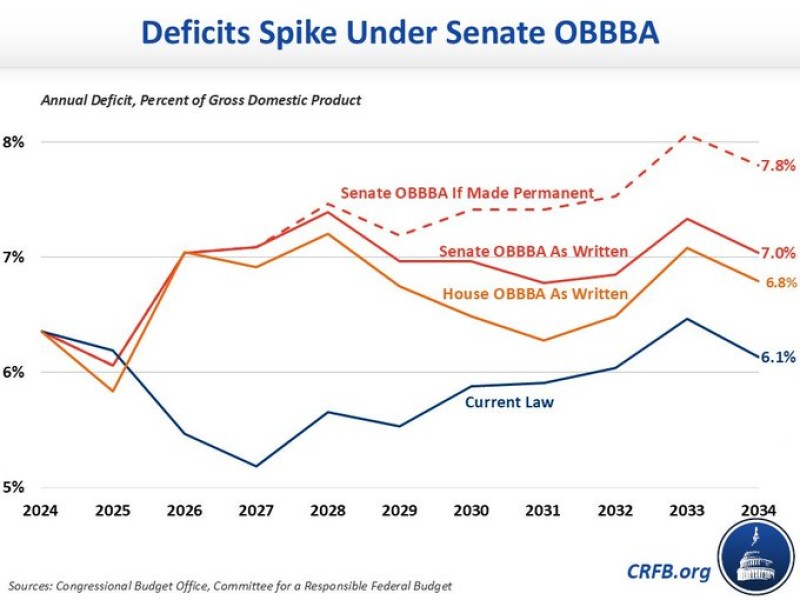

Annual budget deficits under the Senate’s OBBBA proposal could rise to 7% of U.S. GDP—and potentially approach 8% if the legislation is made permanent. The chart, based on data from the Congressional Budget Office and CRFB, shows a sharp divergence from the current law path, which keeps deficits closer to 6.1% by 2034.

Sharp Divergence from Current Law

While the current law projects a deficit decrease to around 5.2% in 2027 before gradually increasing to 6.1% by 2034, the Senate OBBBA proposal charts a much steeper path. The Senate plan, as written, maintains deficits at around 7% of GDP over the next decade, while the permanent version peaks near 7.8% by 2034.

Rising Fiscal Pressures Ahead

Both House and Senate OBBBA proposals significantly exceed the 3% deficit-to-GDP benchmark that economists often cite as sustainable. As spending rises and revenues remain constrained, policymakers may face mounting pressure to revise the legislation or find new offsets to stabilize long-term debt levels.

Conclusion

With deficits projected to climb rather than shrink, the OBBBA proposals have reignited debate about fiscal responsibility in Washington. Unless corrective action is taken, the gap between spending and revenue could widen further—posing challenges not just for budget hawks, but for the broader economy in the years ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis