As the stock market rallies in the midst of the economic downturn, some become concerned about such a disconnect. Experts like Mohamed El-Erian attribute the growth to the Fed’s interventions. Peter Brandt recently expressed an alternative point of view.

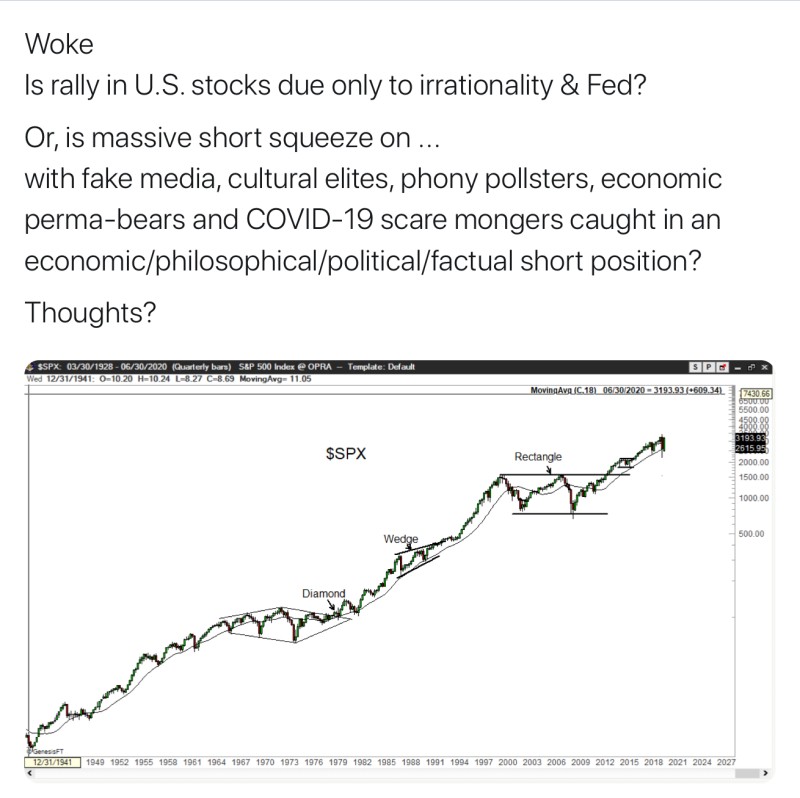

Peter Brandt is no stranger to charts and technical analysis. Hence, his outlook on the reason for equities’ climb is less fundamental. In his recent tweet, Peter pointed out that short squeezes may be pushing the prices higher.

In Brandt’s view, there may be a substantial number of people, who are bearish on the stock market. Accumulated short positions are like a compressed spring for the market. If the prices go too high, short-sellers get squeezed and have to close their positions, driving demand for stocks up.

Summarizing Brandt's technical opinion and other experts’ fundamental ones, the market may be going through a reinforcing cycle. As the gap between the wall street and the main street is extending, more people may be betting against the market. Meanwhile, some positive economic data like the recent unemployment report or the Fed’s interventions prop the market up. The bears get squeezed, launching stocks even higher to the levels, where other people become bearish.

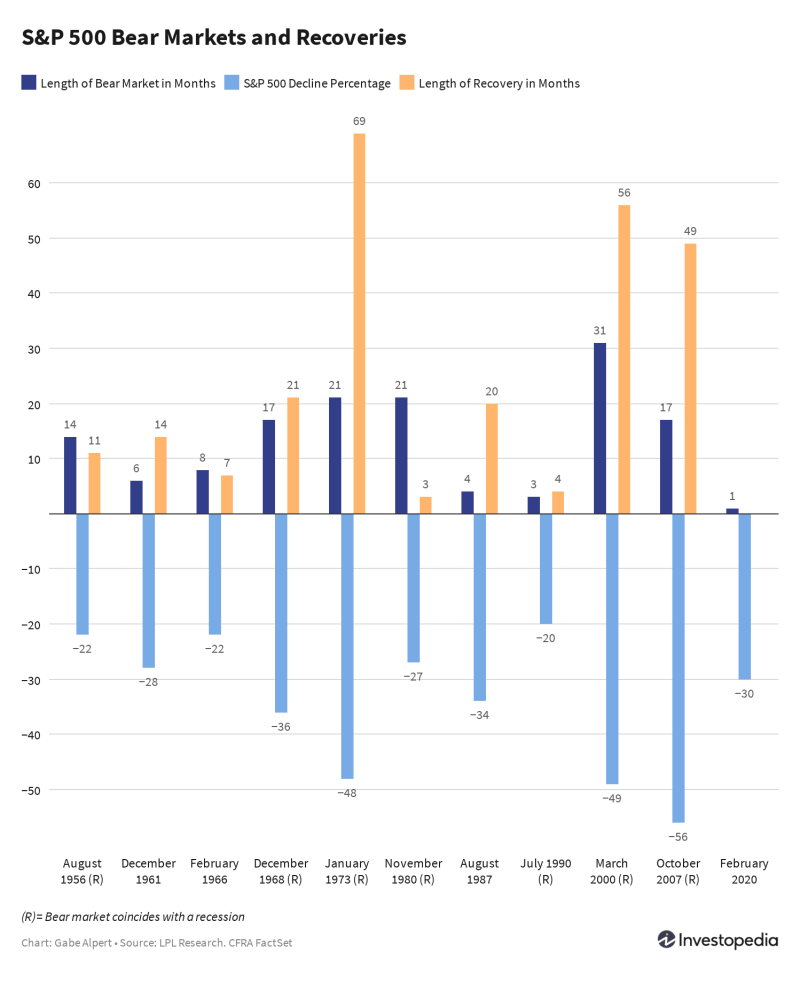

The Fed’s Chair, Jerome Powell, once stated that “you wouldn't want to bet against the American economy”. Statistically, he may have a point. As the historical data shows, in the majority of bear markets, the periods of growth were longer than the periods of decline.

It’s difficult to time markets, especially when the Fed has unlimited buying power. Moreover, short positions are marginal, which creates more risks. A safer approach to avoid being short squeezed may be dollar-cost-averaging into the market. Using this in anticipation of equities’ downfall should provide a good entry point to a long position once the market starts rallying again.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi