If you are having difficulties keeping an eye on all the tech stocks that are traded on the NASDAQ stock exchange, consider trading markets such as the Micro E-mini NASDAQ market.

Advantages of Trading Nasdaq Micro Futures Over Stocks

- You can trade the NASDAQ Futures both long and short with the same margin. This will allow you to take advantage of directional movements either way, up and down.

- You trade the entire index without the challenge of picking individual stocks.

- The NASDAQ market is trading almost 24 hours a day, allowing you to trade during hours that make sense to you.

- You can discuss day trading margins with your broker, and some provide day trading margins of 50% while some may go as low as 5%.

Disclaimer: Trading leveraged financial instruments such as futures involves substantial risk of losing. Past performance is not indicative of future results. You may lose more than your initial investment.

- From a capital efficiency, the margin on the MNQ represents only five to seven percent of the entire contract. You can hedge your portfolio of NASDAQ stocks during volatile periods or downturn by potentially not selling your entire basket of stocks, and place a smaller level of capital to control an entire portfolio.

The NASDAQ Futures are traded on the Chicago Mercantile Exchange, and Futures Brokers provide demos. Consider Optimus Futures, which provide their day-trading software Optimus Flow demo for the entire two weeks. Click Here for a FREE trial.

The small contract of the E-mini Micro NASDAQ may be more suitable for the beginner Futures trader due to its smaller size. The E-Mini NASDAQ is 1/10 of the size of the regular Futures market.

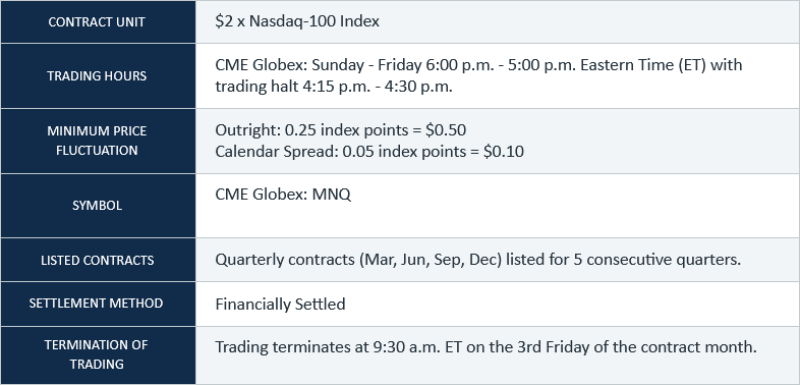

Nasdaq Micro Futures (MNQ) Contract Specifications

The NASDAQ Micro is designed to manage exposure to the 100 leading non-financial U.S. large-cap companies that make up the Nasdaq-100.

How do Traders Use the NASDAQ Micro Futures Contract?

Since futures are leveraged, it is rather hard to trade them fundamentally, unless you have the capital to hold positions overnight. Therefore, many prefer to use the contract for day trading nowadays.

Day traders execute their trades in three ways:

- Trading ModuleThis is just an entry platform. Some prefer to just have a simple trade module with a choice of Buy and Sell, quantity, and the type of order.

- Trading from ChartsSome of the day traders trade from visuals, so they need to see precise support and resistance areas. They prefer to trade from the charts and move their order along the price lines that the charts dictate. These traders are able to recognize repetitive patterns and attempt to capitalize on them. The ability to drag orders and targets makes it rather easy for day traders to manage trades and orders.

- Trading on the DOM (Depth of Market)

Those who day trade on the DOM trade the movement of out of the ordinary large size orders, and also orders that get placed and canceled. Just like visual traders, DOM traders move their orders on the DOM. While DOM Traders rely on the data that is coming from the DOM, they also use charts to gauge the price momentum. DOM trading takes many years of experience because it flashes numbers that come and go, and it would be difficult for beginners to see the pattern that evolves from orders that come and go.

The NASDAQ is comprised of many stocks, however, it’s a weighted average of many stocks, and some of the stocks have a higher weight than other stocks. So, if you decide to day trade the E-mini Micro you should also follow stocks that affect the NASDAQ. For example, if some of the FAANG stocks are going through earning seasons, you may need to watch it as it could affect the NASDAQ Futures overnight moves (if the earning are coming after cash close) and it could also cause gap openings.

In addition to trading the Futures contracts on the Micro E-mini NASDAQ Futures, you can also trade Options on the Micro E-mini NASDAQ options for hedging or speculation purposes.

However, if you are an options trader, you should also consider the Micro E-mini S&P 500 Options because they could have the higher liquidity required in times when markets are highly volatile and may make it hard to liquidate as spreads become very wide.

Options strategies on the Micro E-mini S&P are traded weekly, End of Month, and Quarterly.

This article was created by Matt Zimberg CEO and President Optimus Futures (matt@optimusfutures.com)

About Matt Zimberg

Matthew Zimberg is the Founder and President of Optimus Futures LLC, a leading online futures broker that caters to retail and institutional traders via trading platforms and stable data feeds, commodity trading advisors, and algorithmic trading systems.

Matthew has over 20 years of experience in the futures and commodities markets and has a deep understanding of low latency trading technologies, advanced technical analysis, methodologies and trading software development. He is also a big advocate of risk management.

For more information, please visit their site.

Disclaimer

Trading futures and options involves substantial risk of loss and is not suitable for all investors.

Past performance is not necessarily indicative of future results. The risk of loss in trading commodity interests can be substantial.

You should therefore carefully consider whether such trading is suitable for you in light of your financial condition.

The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you.

You should ONLY trade with risk capital. Risk capital is defined as a capital that if lost would not change your lifestyle and livelihood.

Matt Zimberg

Matt Zimberg

Matt Zimberg

Matt Zimberg