The U.S. inflation rate is steadily declining, nearing the Federal Reserve’s 2% target. This macroeconomic shift has sparked renewed optimism in financial markets, with traders closely monitoring potential changes in monetary policy. For Bitcoin (BTC), this development could act as a powerful catalyst.

U.S. Inflation Trends Lower, Nearing Fed Target

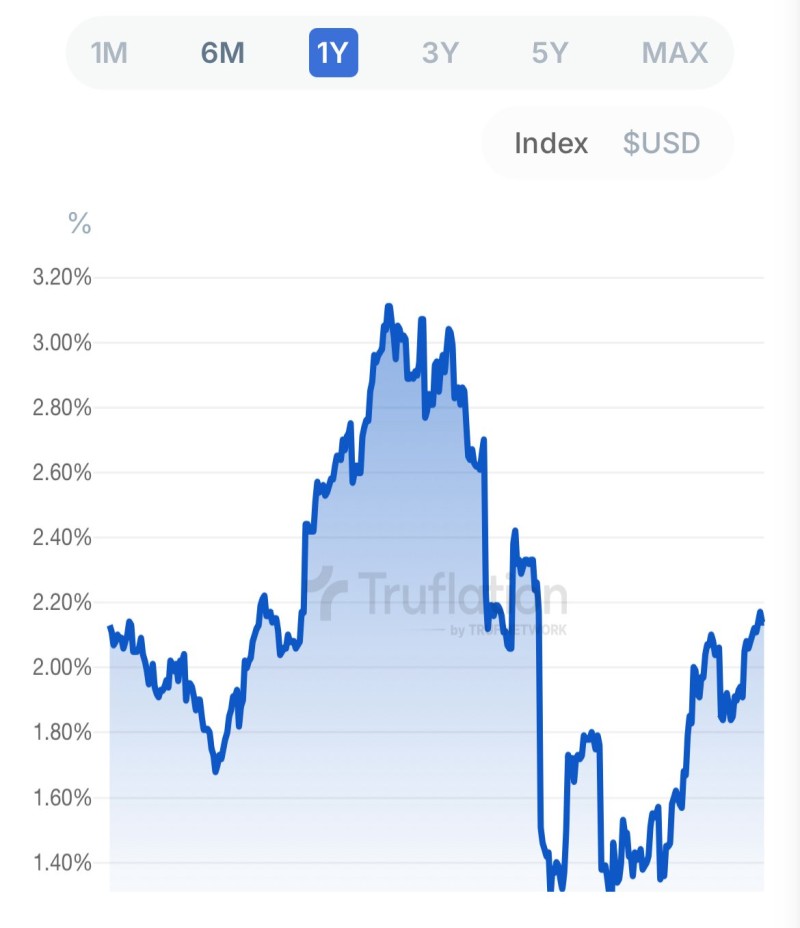

The chart above reflects a clear downtrend in U.S. inflation over the past year. After peaking above 3.2%, the rate has steadily declined and now sits close to 2.2%. This cooling trend marks a significant milestone and suggests that the Fed's tightening cycle may be nearing an end.

The markets are now speculating whether this will lead to rate cuts or simply more cautionary guidance from the central bank. Either outcome will significantly impact investor sentiment across all risk assets, including cryptocurrencies.

Bitcoin (BTC) Price Could Benefit from Policy Pivot

Historically, Bitcoin (BTC) has shown strong performance during periods of easing monetary policy. With inflation trending downward and the Fed potentially approaching a turning point, Bitcoin price could gain momentum.

At the time of writing, Bitcoin (BTC) is trading near key resistance levels. A confirmed Fed pivot could drive prices higher, particularly if accompanied by increased institutional interest and macro stability. For now, traders are waiting to see whether this inflation dip will be enough to push the Fed into action.

Peter Smith

Peter Smith

Peter Smith

Peter Smith