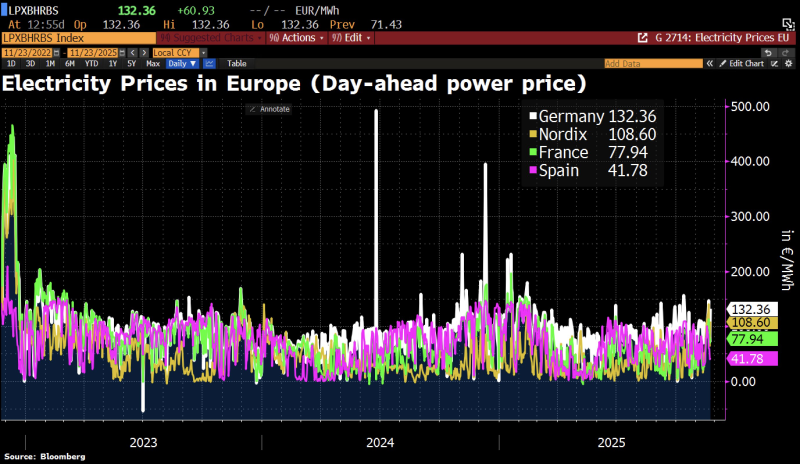

⬤ Germany's electricity costs keep climbing, creating a bigger and bigger gap between Europe's largest economy and its neighbors. Day-ahead power prices in Germany hit 132 euros per megawatt hour, continuing a pattern that's been going on throughout 2024 and into late 2025. For industries that need stable and affordable energy, this has become a serious ongoing problem.

⬤ The latest market data paints a pretty stark picture. Germany's 132.36 euros per megawatt hour is way higher than what other major EU markets are paying. Nordix came in at 108.60 euros, France at 77.94 euros, and Spain at just 41.78 euros per megawatt hour. That means Germany is paying three times what Spain pays and about 75 percent more than France. Looking at the chart from 2023 to 2025, you can see major volatility and repeated price spikes in Germany, pointing to some deep structural issues in the country's energy system.

These conditions are contributing to a meaningful competitive disadvantage for German businesses.

⬤ Other European economies are benefiting from better generation conditions and lower wholesale prices, while Germany's energy mix, grid limitations, and reduced baseload availability keep pushing costs up. The stability you see in France and Spain, reflected in their much lower day-ahead pricing, is raising real concerns about economic divergence within the EU's internal market.

⬤ This growing price gap matters because it affects industrial output, where companies choose to invest, and overall economic performance. High power costs in Germany might push production, especially in energy-intensive sectors, toward markets with more competitive rates. As Europe works through its long-term energy transition, these electricity pricing differences remain a major factor shaping competitiveness and strategic planning across the region.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah