For savvy traders and investors, the relationship between these two giants is not one of opposition, but of opportunity. The ability to move assets between the Ethereum and Bitcoin networks is a fundamental strategy for managing risk, capitalizing on market trends, and diversifying a digital portfolio. This guide will explore the strategic motivations for an ETH to BTC exchange and walk you through how to perform this swap securely and privately.

Why Exchange Ethereum for Bitcoin?

Swapping ETH for BTC is a calculated move driven by several key financial strategies. Understanding these motivations can help investors make more informed decisions about their portfolio allocation.

- Portfolio Diversification and Rebalancing: A core principle of investing is not to put all your eggs in one basket. Holding both ETH and BTC provides exposure to two different value propositions: ETH's utility-driven growth potential and BTC's established role as a store of value. Traders often rebalance their holdings by swapping ETH for BTC after a significant price run-up in Ethereum, thereby locking in profits in a less volatile asset.

- Capitalizing on Market Cycles: The crypto market moves in distinct cycles. Sometimes, "altcoins" like Ethereum outperform Bitcoin (an "altcoin season"), while at other times, capital flows back into the perceived safety of Bitcoin. Astute traders monitor these trends and swap ETH for BTC to position themselves favorably for the next market phase.

- Risk Management: During periods of high market uncertainty or volatility, investors often execute a "flight to quality." In the crypto space, Bitcoin serves as this safe-haven asset. Swapping a portion of one's ETH holdings for BTC can be a prudent risk management strategy to preserve capital during a market downturn.

- Practical Utility: On a more basic level, the need may arise to use Bitcoin for a specific transaction. Despite the growth of Ethereum, Bitcoin remains the most widely accepted cryptocurrency among merchants and services that accept digital payments.

Common Swapping Methods: Custodial vs. Non-Custodial

When it comes to executing an ETH to BTC swap, traders are faced with two fundamentally different types of exchange models: custodial and non-custodial. The choice between them has significant implications for security, privacy, and control.

Custodial Exchanges: The Traditional Way

Custodial exchanges are large, centralized platforms like Coinbase, Kraken, or Bybit. When you deposit your crypto onto these platforms, you are transferring ownership of your private keys to the exchange. They hold your funds "in custody" on your behalf.

- Pros: They typically offer high liquidity, advanced trading tools like order books and charting software, and a user interface that is familiar to those with a background in traditional finance.

- Cons: The primary drawback is a loss of control. The mantra "not your keys, not your coins" is paramount; if the exchange is hacked or becomes insolvent, your funds are at risk. Furthermore, these platforms enforce mandatory Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, requiring users to submit personal identification and linking their real-world identity to their crypto activity.

Non-Custodial Exchanges: The Modern Alternative

Non-custodial instant crypto exchanges represent a modern approach focused on user sovereignty. These services act as intermediaries that facilitate direct wallet-to-wallet swaps without ever taking custody of user funds.

- Pros: This model offers superior security, as the user always retains control of their private keys. It also provides a significant privacy advantage, as many services do not require registration or KYC. They are built for one purpose: to swap assets simply and efficiently.

- Cons: Fees can sometimes be slightly higher than the lowest tier on a high-volume custodial exchange, as they include network fees for the cross-chain transaction.

A Spotlight on Privacy and Simplicity: Swapping with StealthEX

For investors who prioritize security and financial privacy, non-custodial platforms are the clear choice. Among the leading services in this space is StealthEX.io, an instant crypto exchange that has built a strong reputation for its user-centric approach.

StealthEX operates on a simple yet powerful premise: to make crypto swaps easy, secure, and private. Its core features directly address the shortcomings of custodial models.

- Privacy-Focused Framework: StealthEX requires no registration, sign-up, or KYC. Users are not required to submit personal data, allowing them to perform an ETH to BTC exchange or any other swap with complete privacy.

- Non-Custodial Security: The platform is entirely non-custodial, meaning it never stores user funds. All transactions are direct wallet-to-wallet operations. This model eliminates the systemic risk of exchange hacks that have plagued the crypto industry, giving users peace of mind that their assets remain under their control.

- Expansive Asset Support: With a selection of over 2,000 cryptocurrencies, StealthEX offers one of the widest ranges of trading pairs available. This includes the ability to swap not only major assets but also privacy coins like Monero (XMR) and Zano (ZANO), which are frequently delisted from regulated custodial exchanges due to compliance pressures.

- Competitive, Transparent Rates: StealthEX's algorithm integrates with multiple major liquidity providers (like Binance, KuCoin, HTX, Bybit, and MEXC) to find the most favorable exchange rate for the user in real-time. This ensures users receive a competitive price for their swap without having to compare rates across different platforms.

How to Swap ETH to BTC on StealthEX: A Step-by-Step Guide

True to its promise of simplicity, executing a swap on StealthEX is a straightforward process that takes just a few minutes.

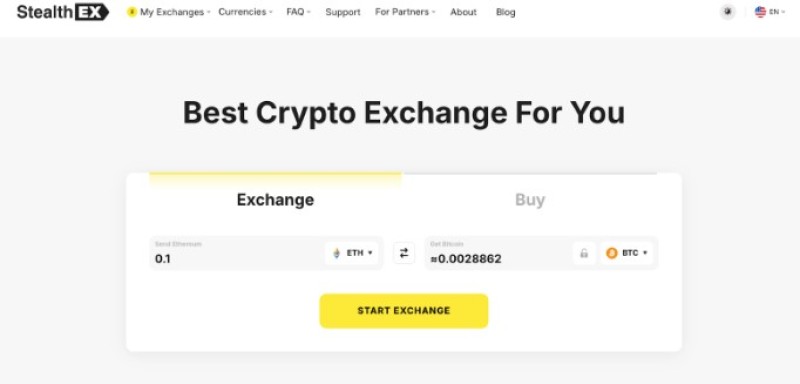

1. Select Your Pair: Navigate to the StealthEX website. In the exchange widget, select Ethereum from the left dropdown list and Bitcoin from the right list.

2. Enter Amounts: Input the amount of ETH you wish to exchange. The widget will automatically calculate and display the estimated amount of BTC you will receive at the current market rate.

3. Provide Your Recipient Address: Carefully enter your personal Bitcoin wallet address. This is the destination where your freshly swapped BTC will be sent. Always double-check this address for accuracy.

4. Confirm and Deposit: The platform will show you a summary of your transaction. Once you confirm, StealthEX will generate a unique ETH deposit address for this specific swap.

5. Receive Your Coins: Send your ETH from your wallet to the address provided in the previous step. Once the deposit is confirmed on the blockchain, StealthEX automatically handles the conversion and sends the Bitcoin directly to the recipient address you provided.

Conclusion

The ability to seamlessly exchange ETH for BTC is a vital tool in any crypto investor's arsenal, allowing for strategic diversification, risk management, and profit-taking. While traditional custodial exchanges offer one path, they come with significant trade-offs in privacy and security.

For the modern trader who values control over their assets and the right to financial privacy, non-custodial platforms offer a superior alternative. By facilitating direct wallet-to-wallet swaps without requiring registration, services like StealthEX provide a secure, simple, and private solution. By combining a massive selection of assets with competitive, real-time rates, StealthEX stands out as an ideal choice for anyone looking to navigate the crypto markets with confidence and privacy.

Editorial staff

Editorial staff

Editorial staff

Editorial staff