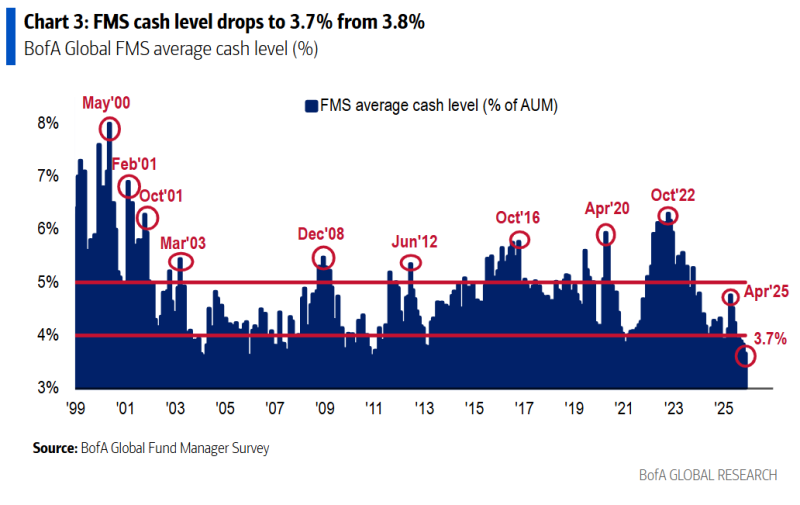

⬤ BofA's newest Global Fund Manager Survey reveals average cash allocations have fallen to just 3.7% of assets under management, hitting one of the lowest points in decades. Bank of America's analysis shows that whenever cash dropped to 3.7% or lower since 2002, it happened 20 times, and every single time equities pulled back while Treasuries rallied over the next one to three months. The current reading sits near the bottom of the historical range.

⬤ Cash exposure across global fund managers has been steadily declining, now hovering just above multi-decade lows last seen during May 2000, February 2001, December 2008, June 2012, and October 2022. Each of these moments came when managers were heavily positioned in risk assets, and what followed matched BofA's pattern: weaker stocks and stronger Treasury performance.

⬤ BofA's cash level indicator is closely watched as a gauge of market positioning. The 3.7% reading falls well under the 5% mark that typically signals caution, showing most portfolios are fully invested. Current levels mirror earlier cycles when dropping cash positions went hand-in-hand with increased risk exposure.

⬤ This trend matters because extremely low cash holdings strip away flexibility and leave managers more exposed to market downturns. With BofA's track record showing equities underperforming and Treasuries outperforming after similar readings, the current 3.7% level could mark a shift in how global markets behave in the coming weeks.

Peter Smith

Peter Smith

Peter Smith

Peter Smith