Best crypto stocks to buy in 2025: top digital assets to invest

Choosing the best crypto stocks to buy in 2025 isn’t as simple as looking at last year’s winners. The market keeps shifting: token prices recover, ETFs bring new money in, and blockchain companies start acting more like traditional tech firms. For investors, this mix of innovation and volatility creates both opportunity and confusion.

Some crypto projects are proving their long-term value through consistent upgrades, strong user growth, and real-world adoption. Others still rely on hype alone. In this article, we’ll focus on three cryptocurrencies that stand out today – assets backed by solid fundamentals, clear roadmaps, and active communities driving their growth.

Bitcoin: still one of the best crypto stocks to buy

Bitcoin remains the cornerstone of the crypto market and one of the best crypto stocks to buy for investors who value stability in a volatile space. After hitting new all-time highs in 2025, Bitcoin continues to attract both institutional and retail investors, supported by the growing popularity of spot ETFs and adoption by major financial firms. Its limited supply and predictable issuance model make it a digital equivalent of gold – a hedge against inflation and currency devaluation.

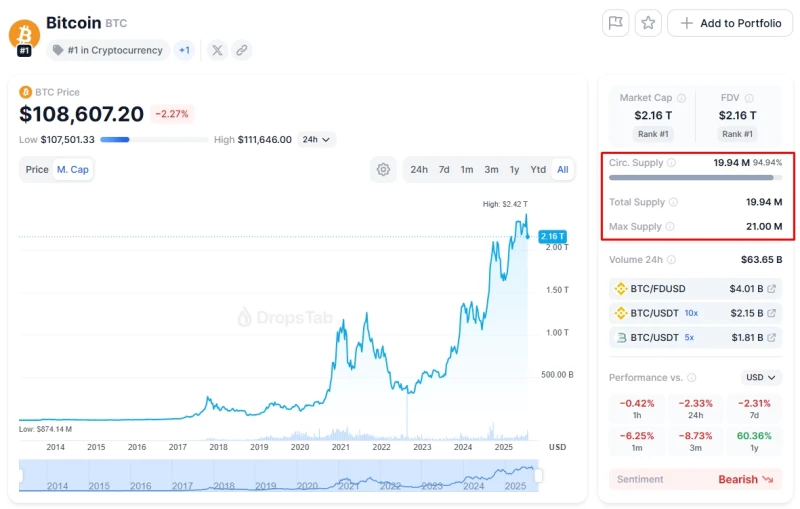

Data on Bitcoin’s circulating and maximum supply. Source: dropstab.com

What makes Bitcoin stand out now is its maturity. Unlike many altcoins that depend on speculation, Bitcoin’s network is proven, secure, and globally recognized. Transaction volumes on the Lightning Network are rising, showing its growing use for real payments, not just investment. Analysts note that as global liquidity returns and monetary policy eases, demand for Bitcoin tends to rise faster than for traditional safe havens.

While the price may still fluctuate, Bitcoin’s long-term trend remains upward. For investors building a diversified portfolio, it continues to serve as the anchor asset of the crypto sector - a rare mix of liquidity, brand trust, and long-term potential.

Polkadot: what crypto to buy now for cross-chain growth

Polkadot remains one of the most promising networks for interoperability, making it a strong contender for what crypto to buy now. Its unique parachain architecture allows multiple blockchains to connect and share data seamlessly, solving one of the biggest limitations of the Web3 ecosystem – isolation between networks. This structure lets developers build specialized chains for DeFi, gaming, or real-world assets while still benefiting from Polkadot’s shared security and scalability.

Recent updates show steady activity across parachains, including integrations that improve staking, cross-chain transfers, and decentralized identity solutions. Although DOT’s price has lagged behind some newer tokens, on-chain data points to healthy developer engagement and network usage. Analysts view this as a signal that Polkadot is building long-term value rather than chasing hype cycles.

The project’s upcoming upgrades aim to improve performance and interoperability further, reinforcing its position as a core infrastructure layer for decentralized apps. Those who want a closer look can read deep dive is Polkadot dead breaks down current metrics and ecosystem trends.

With its strong tech foundation and expanding developer community, Polkadot continues to prove that real utility, not speculation, drives sustainable crypto growth.

Hyperliquid (HYPE): the best crypto stock to buy for high-performance trading

Among the new wave of Layer-1 projects, Hyperliquid stands out as one of the best crypto to invest in right now for traders who care about both speed and transparency. Built specifically for decentralized derivatives, Hyperliquid combines the efficiency of centralized exchanges with full on-chain execution – a rare balance that few platforms achieve. Its network supports up to 200,000 transactions per second and confirms trades in under a second, creating a CEX-level trading experience while keeping assets self-custodied.

The backbone of this system is the HyperBFT consensus and an on-chain order book, which replaces automated market makers with deep liquidity and precise price discovery. Traders can open leveraged perpetual positions, bridge assets from multiple networks, and use tools like vaults and cross-margin accounts – all directly on-chain.

Interface of the Hyperliquid crypto exchange shown with the MONUSD trading pair. Source: hyperliquid.xyz

The project’s native token, HYPE, powers governance, staking, and gas fees within the ecosystem. It also benefits from one of the most aggressive token buyback systems in DeFi – over 90% of platform revenue is used to repurchase HYPE, reducing supply and rewarding long-term holders. Early airdrop participants saw significant gains, but the project continues to attract new traders as daily volumes exceed billions of dollars.

While Hyperliquid is still relatively young compared to Ethereum or Solana, its architecture and product-focused approach position it as a major contender in on-chain finance. For investors seeking exposure to the future of decentralized trading infrastructure, HYPE represents a bet on speed, liquidity, and the growing convergence of DeFi and professional markets.

Editorial staff

Editorial staff

Editorial staff

Editorial staff