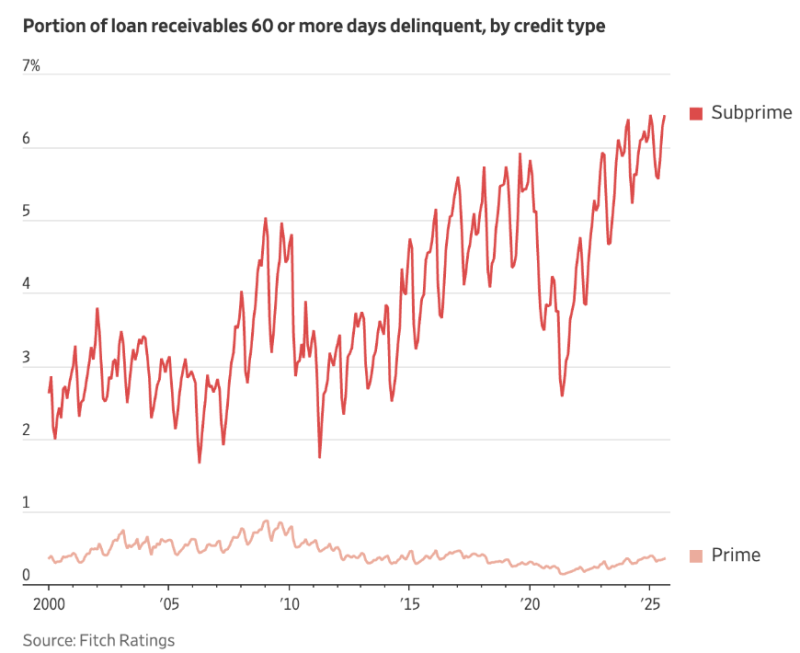

● Stock Sharks recently pointed out that U.S. subprime auto loans that are 60+ days past due hit a record 6.4%, based on Fitch Ratings data. This is the highest delinquency rate the auto finance sector has ever seen, showing how high borrowing costs and stubborn inflation are hitting vulnerable borrowers hard.

● The jump in late payments reveals serious trouble in subprime lending, where people with lower credit scores are struggling to keep up. With auto loan rates near multi-decade highs, many households simply can't afford their monthly payments anymore. Analysts worry this could lead to more defaults, increased repossessions, and potential bankruptcies among smaller lenders with heavy subprime exposure.

● The trend carries broader risks for both auto and credit markets. Lenders might need to set aside more money for bad loans and tighten lending standards, which could reduce credit availability and hurt car sales. Investors in auto-backed securities—a key funding source for subprime lenders—may demand higher returns, making credit even more expensive for lower-income borrowers.

● Fitch data in the chart shows prime auto loan delinquencies holding steady around 0.5%, highlighting a growing gap between high and low-credit borrowers. This split demonstrates how aggressive rate hikes hit subprime consumers hardest—they're typically the first to crack when household budgets get tight.

● "The subprime auto sector is often the canary in the coal mine," Stock Sharks noted, suggesting that rising car loan delinquencies might preview broader credit problems in areas like credit cards and personal loans. With inflation still eating into wages and limited refinancing options, the record 6.4% delinquency rate could be an early warning sign for the entire U.S. consumer credit system.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah