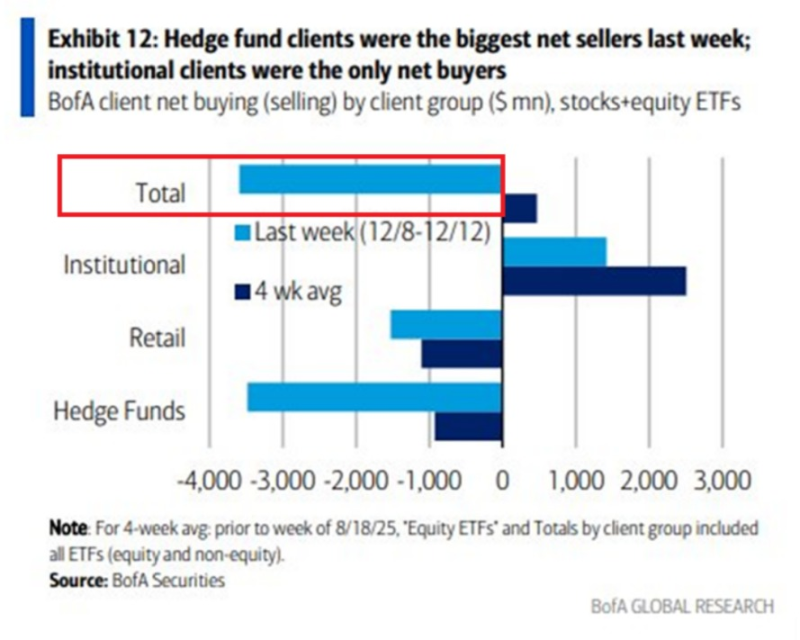

⬤ US equities faced selling pressure last week as market flows stayed negative, extending a prolonged withdrawal period. Total US equity outflows hit around $3.6 billion, marking the ninth week of net selling in the last 13 weeks. Bank of America Global Research data shows hedge fund clients led the selling, while institutional clients were the only net buyers during this period.

⬤ Single stocks and ETFs told different stories. Single stocks saw about $4.9 billion leave the market, representing the sixth weekly outflow in seven weeks. ETFs partially cushioned the blow with roughly $1.3 billion in inflows. ETF buying has been remarkably consistent, showing net inflows in 32 of the past 34 weeks as investors use them to stay in the market despite volatility.

Hedge fund clients as the largest net sellers, while institutional clients stood out as the only net buyers during the period.

⬤ Different investor groups are taking opposite positions. Hedge funds dumped approximately $3.5 billion in equities last week, pushing their four-week average outflow to around $900 million. Retail investors joined the exodus, selling about $1.5 billion in their sixth straight week of selling. Meanwhile, institutional investors swam against the current, adding roughly $1.4 billion and extending their buying streak to four weeks.

⬤ These flow patterns matter because they show how year-end positioning is shaping market behavior. Steady ETF inflows and institutional buying signal ongoing demand for equity exposure, even as hedge funds and retail investors pull back. The persistent single-stock selling could drive uneven performance across different market segments. As the year winds down, the clash between institutional buying and broader selling pressure will likely drive near-term price moves and market sentiment.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi