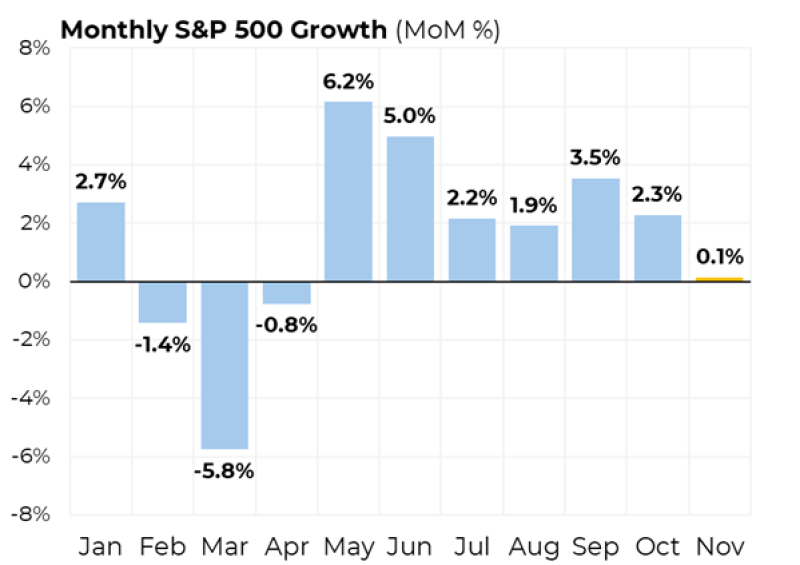

⬤ The S&P 500 ended November almost unchanged halting an even climb. The index rose just 0.1 % from October, its smallest gain since April and a sign that the long rally might be tiring.

⬤ The year began with trouble - February dropped 1.4 %, March fell 5.8 % and April slipped 0.8 %. Sentiment turned in late spring. May leapt 6.2 % plus June added 5.0 % starting a climb that continued through summer. July advanced 2.2 %, August rose 1.9 % and September climbed 3.5 %. October gained 2.3 % - November's pause stood out.

November's flat result matters for year end positioning.

⬤ November was the first real break since the rally began in late spring. The steady gains from July through October showed steady buying, but November's near zero reading shows the mood has shifted. The flat bar beside earlier rises illustrates the lost momentum.

⬤ The slowdown matters after such a strong run in large cap stocks. Investors now weigh year end trades and the outlook for 2026. Growth has slowed to its weakest pace in seven months leaving the market to decide whether December revives the advance or extends the pause.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah