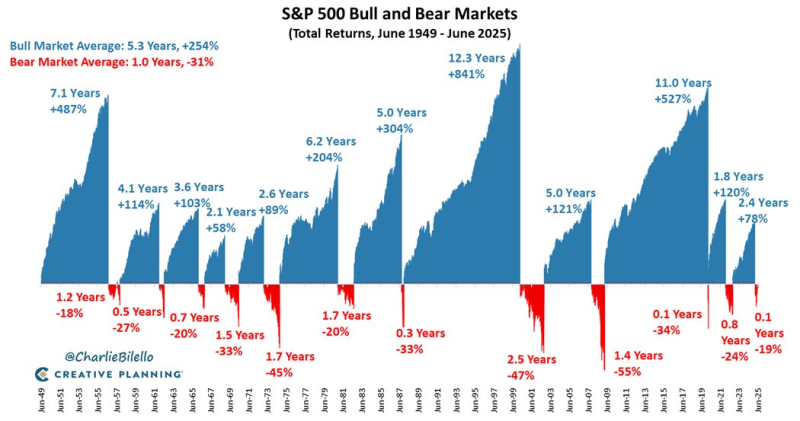

● Charlie Bilello from Creative Planning recently analyzed seven decades of S&P 500 data (1949–2025), and the numbers tell a compelling story: the market spends way more time building wealth than losing it. Bull markets have averaged 5.3 years with gains of around +254%, while bear markets typically last just one year with losses of roughly –31%.

● The key takeaway? The biggest risk isn't market volatility—it's stopping the compounding process. As Bilello points out, even though downturns happen regularly, the market's long-term trajectory rewards patience over panic. Investors who bail during bear markets often miss the strongest rebounds, which tend to happen right after sharp drops.

● The numbers back this up. The longest bull run stretched 12.3 years (1987–2000) and delivered an incredible +841% return. Even after brutal crashes like the –55% decline from 2007 to 2009, the market recovered and hit new highs within a few years. Across more than seventy years, bull markets have consistently beaten bear markets in both length and returns.

Bull markets have lasted five times longer than bear markets on average. Markets spend far more time growing wealth than destroying it — why interrupting compounding is the biggest risk of all. According to Charlie Bilello

● These findings show just how resilient U.S. stocks have been through wars, inflation spikes, and policy upheavals. For investors, the message is simple: staying in the market matters more than timing it perfectly.

Usman Salis

Usman Salis

Usman Salis

Usman Salis